Article

Current State of AI Adoption & Chatbots for Ecommerce Brands

The Agentic AI Hype & The Reality of Adoption

How Shopper Behavior is Changing With AI

During the recent Black Friday & Cyber Monday period, AI-driven traffic to U.S. retail sites surged 805% year-over-year, and shoppers using AI were 38% more likely to buy, according to Adobe Analytics. This surge in AI usage for ecommerce shopping (or “agentic commerce”) represents a dramatic change in the consumer purchasing funnel.

Old Funnel:

- Customer searches for “best shampoo” on Amazon (or Google)

- Browses 5 options from the search results page

- Buys (typically based on price, reviews, and shipping speed –– or whichever seller has earned the buy box).

Agentic AI Shopping Funnel:

- Customer opens AI chatbot (ChatGPT, Gemini, Amazon Rufus, Walmart Sparky) and types, “I need a shampoo for dry hair under $20”

- The AI researches available products within their criteria and recommends matching items

- Customer selects the product they want from the recommended list and approves it for purchase.

Is Agentic AI Adoption Growing as Quickly as It Seems?

On Amazon, over 250 million shoppers used the marketplace’s chatbot, Rufus, in 2025. But what we don’t know is if the way Amazon has integrated Rufus into the shopping experience is artificially inflating that engagement. For example, is it considering Rufus’s pre-loaded questions on product pages as part of this usage? If so, that data is artificially inflated.

On the other hand, if we’re looking at off-marketplace shopping originating from AI agents like ChatGPT or other LLMs, we can’t reliably say how high adoption is right now, or how much it is likely to increase. Realistically, most people aren’t tech-savvy with AI tools yet, so completely assuming that everyone’s shopping habits are changing is probably inaccurate and will likely take a long time.

We’re just starting to dip our toes into knowing what the impact of AI will look like for brands. However, we generally recommend that brands do need to start thinking about what optimizing for agentic AI shopping looks like, as adoption will likely continue to grow over the next few months and years.

Right now, what we know is that Amazon Rufus, Walmart Sparky, ChatGPT, Gemini, and other AI chatbots exist, and adoption is increasing––even if slowly. But this doesn’t mean we need to rewrite the whole “playbook” or completely scrape PDPs. The work you’ve likely already done up to this point (imagery, copywriting, and review generation) is still extremely valuable and sets a strong foundation for how your products may be discussed by these AI chatbots.

New Marketplace Leadership Changes & AI Investments

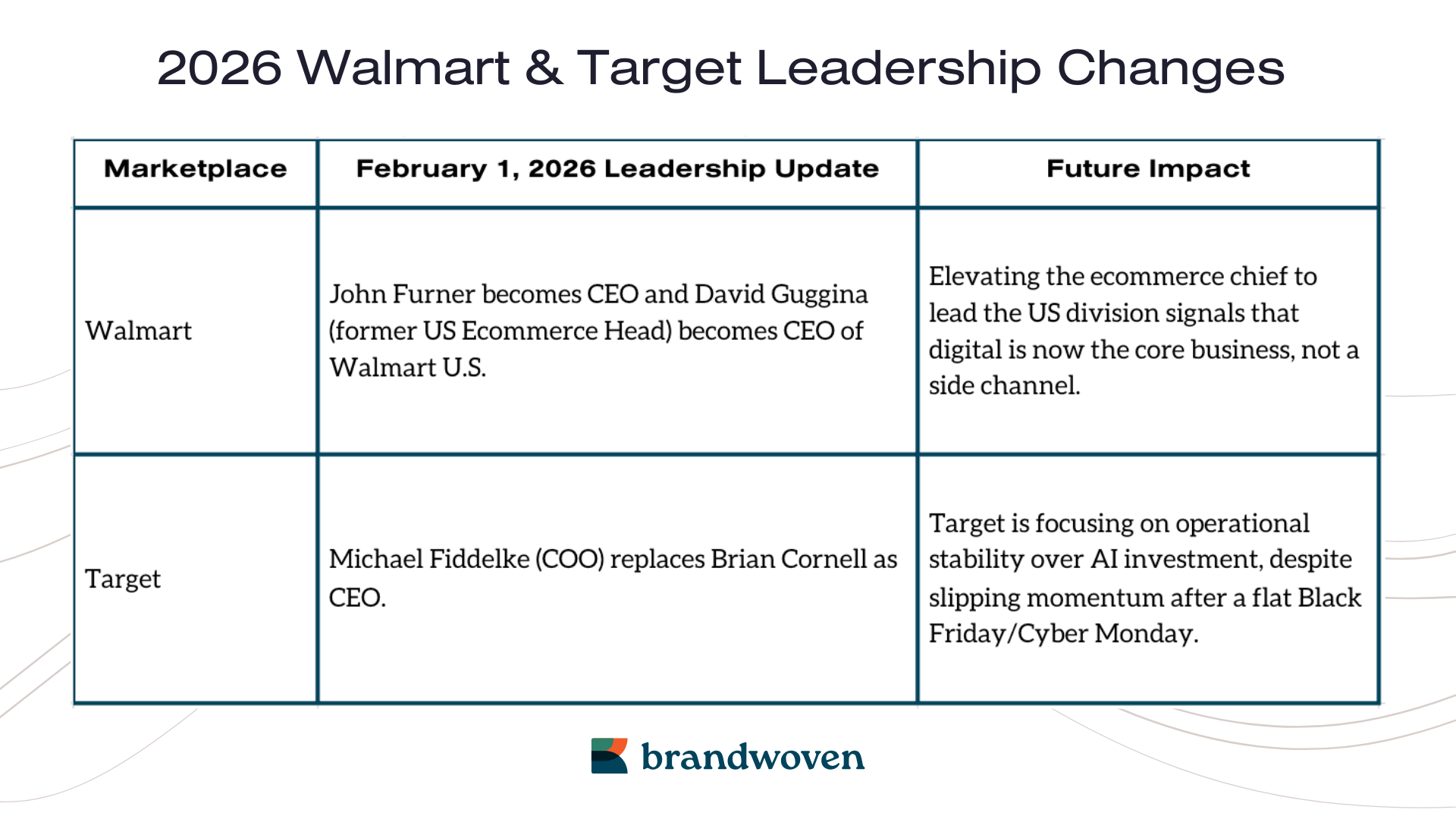

As of February 1st, Walmart and Target have new leadership, signaling which areas of the business they’re doubling down on.

Walmart

Walmart is welcoming a new President and CEO, John Furner, with David Guggina (former US Ecommerce Head) appointed President and CEO of Walmart U.S.

Furner described the announcement as aligning with Walmart’s strategy to centralize the company’s platforms and accelerate shared, tech-enabled capabilities while Guggina added, “This is a unique moment in retail. AI is changing how people shop, and customer expectations are higher than ever. But no one is more prepared to usher in the next era of retail.”

These recent promotions imply Walmart’s serious investment to prioritize digital channels and comes as a direct move to compete with Amazon as a tech-first retailer.

Target

Target CEO, Brian Cornell, has “struggled to turn around weak sales in a more competitive retail landscape… losing market share to rivals like Walmart” and will step down to be replaced by an insider, Michael Fiddelke (former COO).

This update suggests Target’s focus is on operational stability as Emarketer called it “doubling down on the status quo”.

This comes after recent Black Friday & Cyber Monday data showed largely flat foot traffic (lagging behind Walmart), further emphasized by the company’s lack of investment in AI.

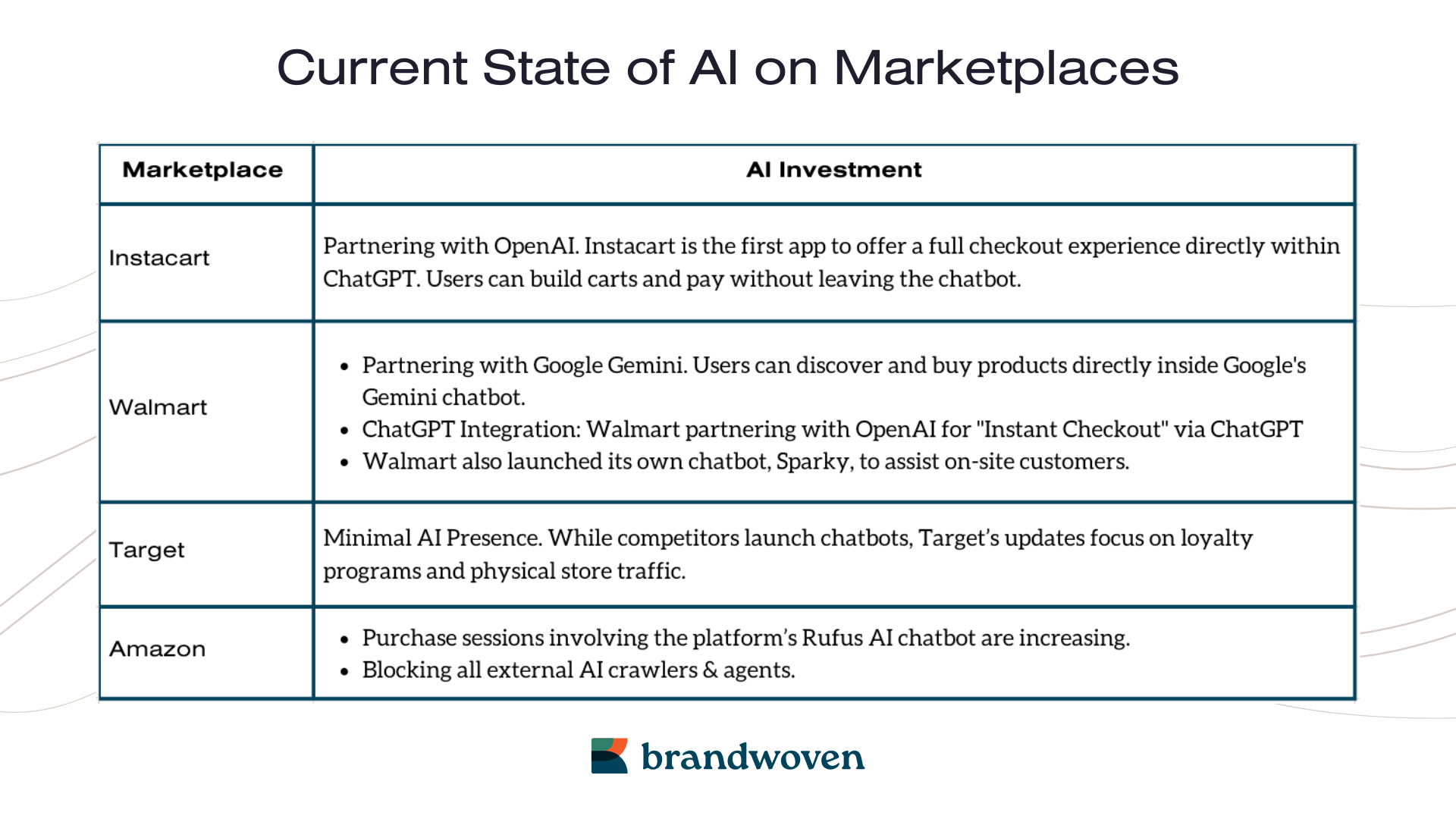

Now we’ll break down how each online marketplace’s current investment in AI (or lack thereof) ––including Instacart and Amazon––impacts brands.

Status of Agentic Commerce on Each Online Marketplace

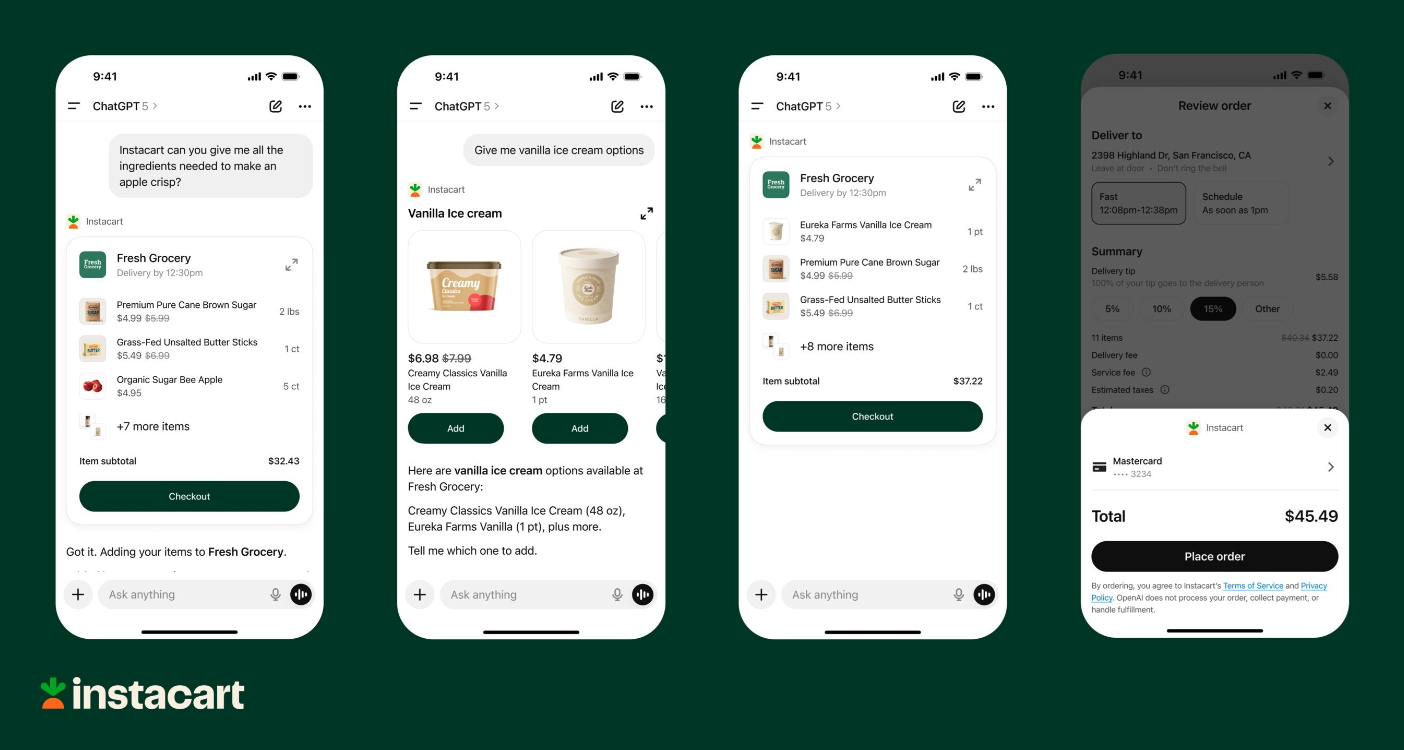

Instacart: OpenAI’s Embedded Partner

Instacart uses a technology (“Agentic Commerce Protocol”) that allows an AI (like OpenAI’s models) to read a product catalog and execute a transaction. The app has now become the first platform to launch an embedded “Instant Checkout” inside ChatGPT. Users will now be able to build carts and pay without ever leaving the conversation. Instant Checkout is rolling out to the app and is currently available on desktop & mobile web.

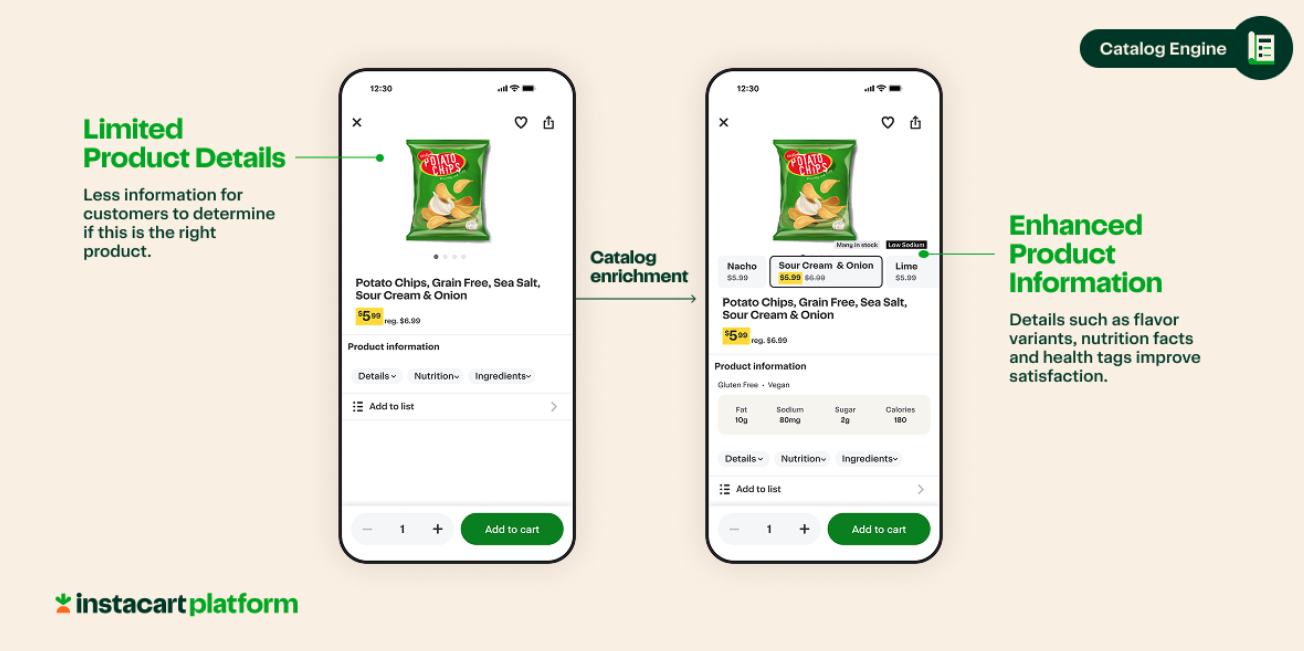

Internally, Instacart is also using AI to clean up nutrition and ingredient data (known as the “Catalog Engine” concept). With this new knowledge, brands who are actively selling on Instacart should prioritize this renowned importance on their catalog data (eg: ensuring detailed product specs).

Walmart: The Hybrid Strategy

The new incoming leadership represents a tech-first future at Walmart. The digital marketplace may no longer be looked at as a side channel but potentially the core business. Walmart is betting that its ecommerce sales, especially those powered by the marketplace’s own agentic AI chatbot (Sparky) and LLM partners (OpenAI & Gemini), will grow.

External AI Partners

Walmart is partnering with Google Gemini and OpenAI to capture traffic before it reaches the store.

- Google Gemini: Walmart’s partnership allows users to discover and buy products directly in the chatbot.

- ChatGPT Integration: Walmart, now partnering with OpenAI, can offer the chatbot’s users “Instant Checkout” via ChatGPT.

Aside from likely increases in Walmart sales through these partnerships, we may also see new client bases discovering Walmart through these tools or even driving customers away from Amazon (for similar products that are available at Walmart via ChatGPT/Gemini).

Internal AI Chatbot: Walmart Sparky

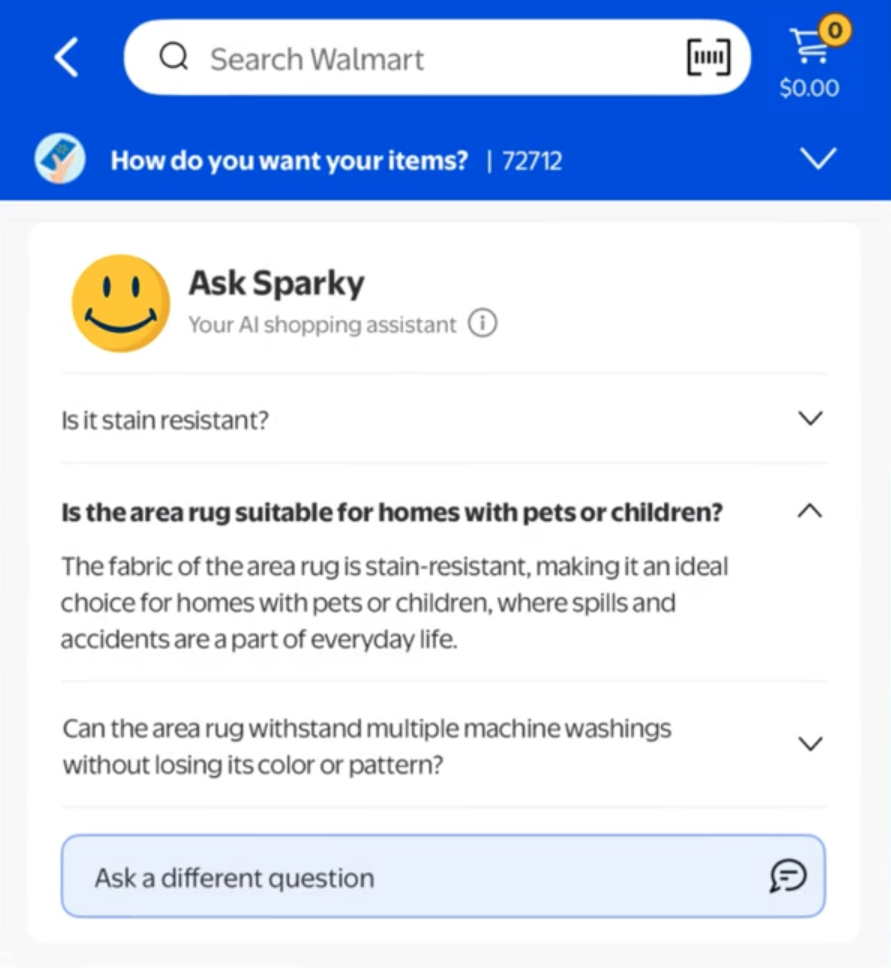

Walmart’s new ecommerce AI chatbot, Sparky, isn’t just a response to Amazon’s Rufus chatbot. Sparky goes beyond synthesizing reviews and helping customers search to find items; Sparky can solve problems and help users plan for specific occasions. For example, a customer can ask to “check the weather at the beach they’re heading to — and get the perfect outfit recommended”. Sparky can put together entire carts based on events rather than just single-item searches.

What This Means for Walmart Sellers

What This Means for Walmart Sellers

Before rushing to make any changes to your product pages, these updates suggest that the rich, descriptive copy you’ve already written—explaining how and when to use your product—will help you gain visibility as AI chatbots begin surfacing products as “solutions” to shopper product criteria. Current ecommerce listings are not likely to automatically start doing poorly (unless product page content is outdated or poor quality in itself), but this new knowledge on how the AI chatbots surface certain products can be layered in as an additional consideration when optimizing your Walmart product pages’ digital merchandising for improved brand awareness.

Amazon: Defensive Approach to External AI Partnerships

Unlike Walmart’s hybrid approach to capturing traffic off-platform via ChatGPT/Gemini and on-platform via Sparky, Amazon is taking a defensive “walled garden” approach, prioritizing its own ecommerce chatbot, Rufus, over any external AI partners.

Amazon is blocking all external AI crawlers, including OpenAI and Perplexity. Over the holidays, Amazon pushed back when Perplexity launched an agentic AI shopping tool for its U.S. users, browsing the ecommerce marketplace products on its users’ behalf. In response, Amazon sued the company for removal of the AI chatbot’s ability to scrape its marketplace data.

For brands on Amazon, this makes one thing clear: Amazon is betting that shoppers will start their search on Amazon.

Target: The Marketplace Traditionalist

Target is notably absent from the agentic AI “arms race”. Brands selling on this marketplace risk losing visibility unless taking an omni-channel approach (either selling on other marketplaces or their own D2C website). For brands focused only on their Target presence, visual merchandising and in-store loyalty must be the priority for success as the tech is lagging.

The Importance of a Strong Marketplace Foundation

Do Brands Actually Need to Optimize for AI?

A detailed, accurate, and already-optimized product page is likely already “bot-ready”. This is because AI shopping agents (like Walmart Sparky) need to first read your product page in order to recommend it to users.

For example, all of the data associated with a product page on Amazon is searchable. If you’re selling a particularly old product that’s historically produced a ton of data for Amazon to use, that’s all already giving Rufus a solid starting point in understanding what the product is and what customers think about it. In cases like this, simply rewording a bullet point to “optimize for AI” is highly unlikely to actually change any results. Again, this is because Rufus can already read all the reviews, customer questions, even old bullets and current bullets, and other backend attributes to analyze the product. In other words, context changing in bullet points isn’t going to drastically move the needle –– but this is a good thing.

If you have been following our marketplace best practices for a while now (eg: including specific product features, use cases, and benefits), you are already ahead. These AI shopping agents are relying on this data to answer user questions like “Is this product safe for toddlers?” The work you’ve already done is going to start your ecommerce brand off stronger when it comes to AI chatbot visibility.

This reinforces the importance of your review generation strategy, catalog set up, and digital merchandising assets as your product data and the “social proof” you’ve collected from reviews is now being read by the algorithm to verify product quality and fit.

If you’re looking for a place to start optimizing for AI, we recommend conducting a catalog and customer experience audit to ensure everything is set up properly and all product assets are as high-quality as they can be. Reach out to our team if you need assistance driving these changes forward.

New Opportunities Available for Brands in 2026

Although a strong foundation is currently your best bet for being surfaced in OpenAI, Google, or other ecommerce AI chatbots, there are a few additional areas brands on Instacart and Walmart can explore for further momentum.

Instacart: Review & Improve Product Attributes

Leverage knowledge of Instacart’s catalog engine which uses AI to read deep product attributes. Sellers can now use this context to layer in additional details like nutritional and ingredient data into listings. This addition can help ensure products are recommended when a user asks ChatGPT for something that fits their specific limitations (eg: gluten-free dinner).

Walmart: Explore Fulfillment & Event-Based Product Scenarios

- Fast Fulfillment: Explore expanding your use of Walmart Fulfillment Services (WFS), if not using it already, to capitalize on the marketplace’s growing priority in fast delivery (44% of Black Friday orders were delivered to customers’ within 3 hours). It’s possible that utilizing WFS will also help your brand win the buy box in Gemini’s search results.

- Specifying Audience Use Cases in Copy: Capture occasion- or event-based traffic by positioning your products as solutions for specific use case scenarios (eg: best toys for a birthday party, safe toys for toddlers, etc.)

Conclusion

The launch of tools like Walmart Sparky, Amazon Rufus, and external partnerships with OpenAI and Gemini prove that many online marketplaces are betting big on AI (with Target still betting that humans want to browse aisles). Bands utilizing these platforms must ensure their strategies align with what each marketplace’s priority is.

These updates signal the opening of a new growth lane for 2026 and beyond: agentic commerce. Although consumer habits change slower than technology, it’s true that product discovery is shifting from human browsing to AI curation. As agentic AI adoption grows, brands need to begin learning how these advancements affect their product visibility.

The good news is that you don’t need to start from scratch. The fundamentals of a great brand—high-quality imagery, accurate data, and strong reviews—remain the best way to optimize for both humans and the new wave of AI shopping agents. This foundation is the prerequisite for success in this new era.

At Brandwoven, we are regularly monitoring these agentic AI shopping shifts. Our team is already working to standardize and improve the way we approach catalog optimization to match these marketplace changes and keep our brands ahead of the curve.

You don’t need to navigate this shift alone. Let us help you run an ecommerce audit, find any missed opportunities, and work with your team to grow visibility with these AI-powered chatbots.