Article

New Amazon FBA Inventory Reimbursement Policy: Managing Sourcing Cost

Effective March 10, 2025, a new Fulfilled by Amazon (FBA) reimbursement policy will go into effect. While Amazon will continue to reimburse sellers, they are changing their reimbursement policy.

How Does FBA Reimbursement Work?

Amazon compensates sellers for lost or damaged inventory when the company is at fault. In the past, reimbursements were based on the estimated sale proceeds. The sale proceeds were the estimated final selling price minus referral and fulfillment fees.

Old Formula Calculation: Final Selling Price – Referral & Fulfillment Fees = Sale Proceeds = Reimbursement Amount

Under this new reimbursement policy, however, Amazon will only reimburse the Sourcing Cost of lost or damaged products. The Sourcing Cost is defined as the Seller’s cost to source the product. A seller can source the product from a manufacturer, wholesaler, reseller, or produce it themselves. The Sourcing Cost excludes shipping, handling, and duties. As a result of this change, many sellers are upset that reimbursements will be smaller than before and not cover all the expenses that were put into getting the product into the FBA warehouse.

Financial Impact of the New Amazon Reimbursement Policy

Given that reimbursements will now be smaller amounts, sellers should now use the following calculation to estimate the financial impact that this policy change will have on their profits.

New Formula Calculation: (Est. Sales Proceeds – Est. Sourcing Cost) * (Forecasted Units Sold * Forecasted % of Units Sold Reimbursed)

Brand Example

A seller with:

- Average selling price: $45

- Referral and fulfillment fees: $12

- Sourcing cost: $15

- Historical reimbursement rate: 0.5% of units

- Annual unit sales: 50,000

- Old policy: ($45 – $12 fees) × (50,000 × 0.5%) = $8,250

- New policy: (($45 – $12) – $15) × (50,000 × 0.5%) = $4,500.

Annual impact: $3,750 in reduced reimbursements

Managing Sourcing Costs

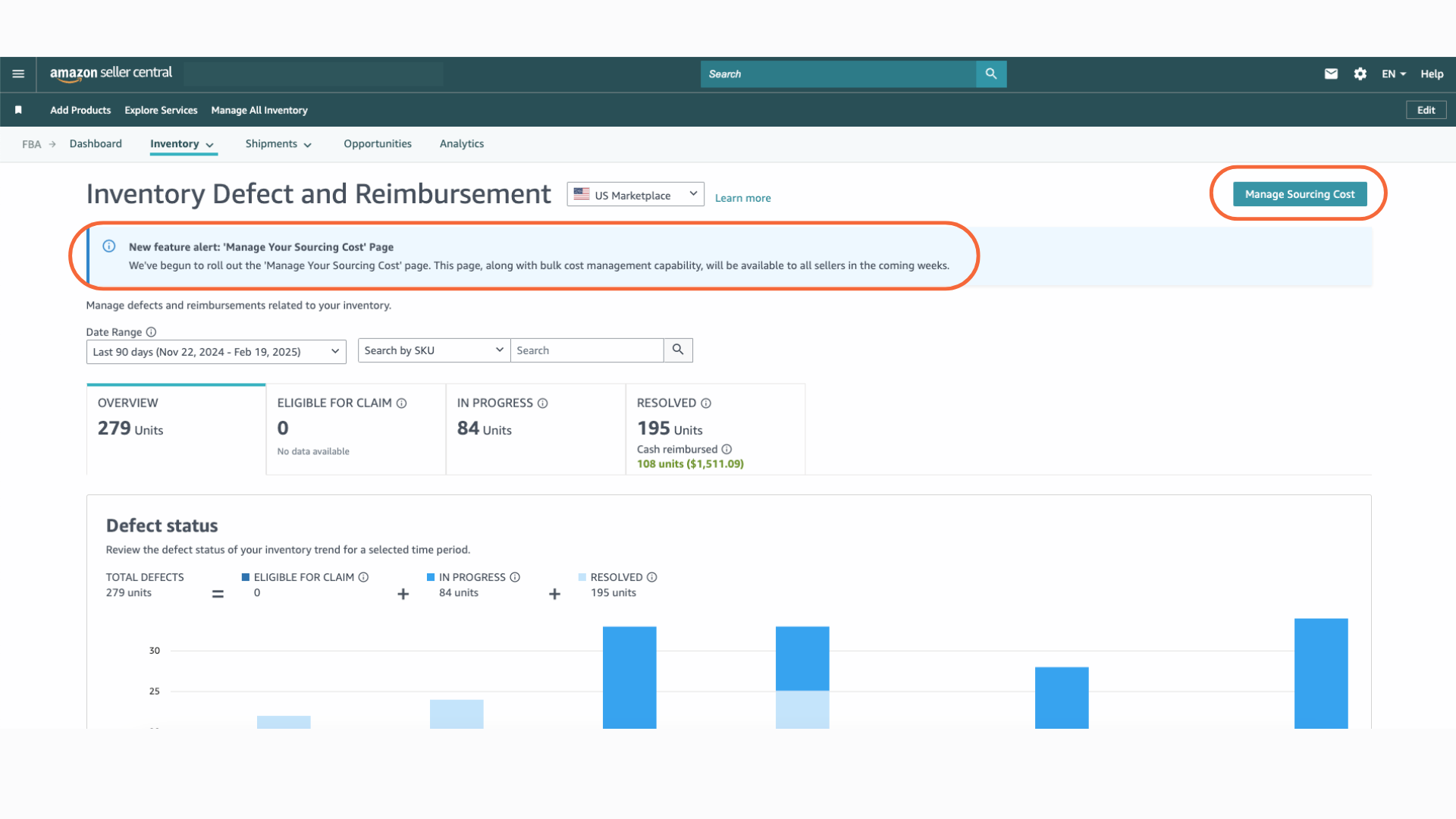

Amazon will provide Sourcing Cost estimates based on an evaluation of comparable products sold by Amazon and other sellers. The costs will be published by Amazon in Seller Central. To see Amazon’s estimated Sourcing Costs, navigate to Inventory > Inventory Defect and Reimbursement and select the box “Manage Sourcing Costs” button in the top right.

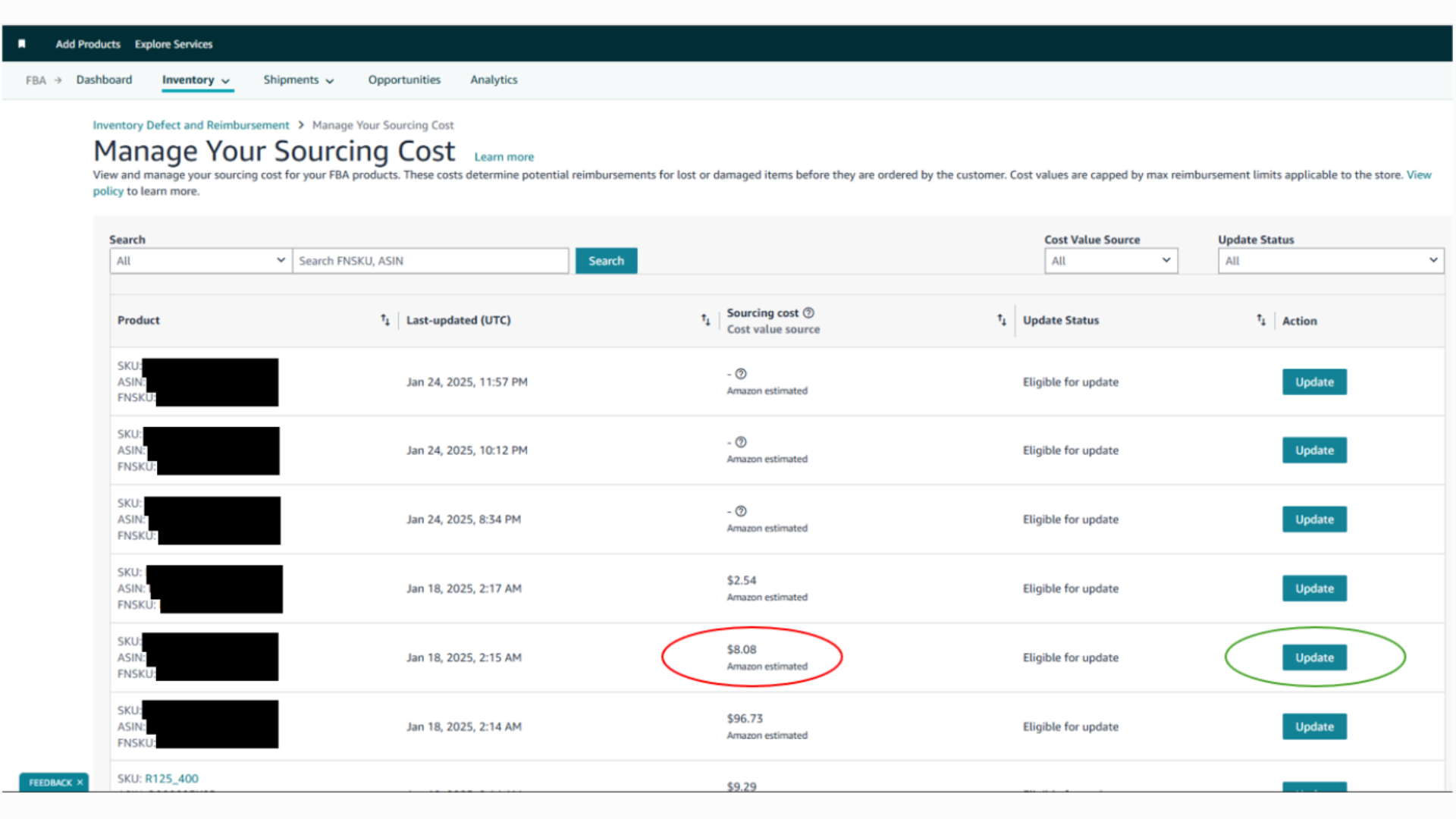

If Amazon’s estimates are lower than the Seller’s actual Sourcing Cost, the Seller can enter and submit their actual costs as proof. To submit Sourcing Costs, navigate to the ASIN you want to change and select “Update” in the action column on the side panel. Note that Amazon is actively developing a way to bulk update Sourcing Costs, however it is not currently available and should be launched over the next few weeks.

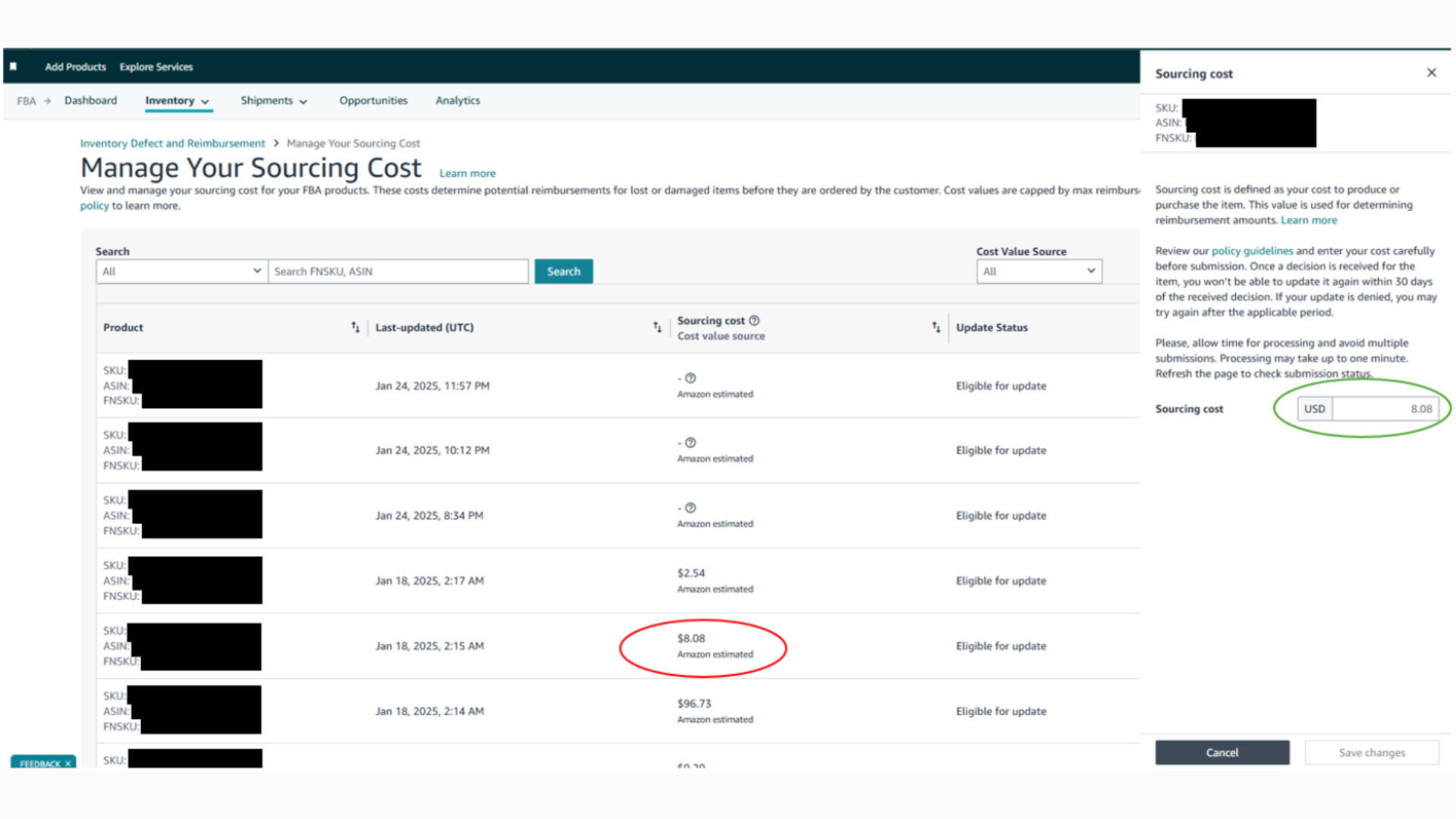

A pop-up will then let you enter the Sourcing Cost. Enter the Sourcing Cost and hit save. Once you submit it, be prepared to prove the submitted value to Amazon.

Strategic Considerations

Before you submit your Sourcing Costs, consider that you are sharing new information with Amazon. Sourcing costs gives Amazon insights into your true margins. Providing that information to Amazon may not be in your best strategic interest. However, it may be required if you are seeing significant losses with a low Sourcing Cost estimate. If you need assistance in determining the best decision for your brand, reach out to our logistics team to receive guidance on how to best manage the shift.

Proof-of-Value Requirement

Amazon may require proof-of-value documentation to accept your Sourcing Cost corrections. Documents accepted as proof-of-value include manufacturer invoices, wholesale invoices, purchase invoices, commercial invoices, or Chinese Fapiao (tax invoices). The documents must include the document name (e.g. “Manufacturer Invoice”), document number (e.g. invoice number), document date (e.g. invoice date), buyer entity name, buyer address, buyer identification (e.g. VAT), issuer entity name, product details (e.g. SKU), product description, product quantity, price [identifies the purchase price], and currency (e.g. USD).

Adapting to the New Amazon Reimbursement Policy

Before the shift goes into effect on March 10, we are recommending that brands try to close out as many reimbursements as possible to receive the maximum possible amount.

Key Deadlines and Next Steps

- Before March 10: close out current reimbursements

- On March 10: new policy goes into effect

This FBA reimbursement policy shift represents a notable change that will impact your bottom line. By proactively managing your Sourcing Cost data, documenting thoroughly, and making strategic decisions about what information to share with Amazon, brands can minimize the financial impact.

While the policy change reduces reimbursement amounts, it also highlights the importance of robust inventory management practices and diversified marketplace presence. At Brandwoven, we’re committed to helping brands navigate these challenges with customized logistics and marketplace solutions that protect margins and optimize performance. Our logistics experts are ready to analyze your specific situation and develop a tailored strategy for you to turn this potential setback into an opportunity for improved operational efficiency.