What We Know & Are Doing to Help Our Brands Prepare

What We Know as it Relates to Amazon

- We have seen paused or cancelled direct import orders – not an unusual behavior as Amazon is creating time to chart a path forward.

- We know Amazon is going to push back on price increase, they always do.

- We know Seller Central brands have more flexibility, and using 3P sellers is a viable alternative to 1P in some instances.

- We know Amazon doesn’t want to see loss of assortment to their customers and will have to work with brands through these changes.

What We Are Doing to Help Our Brands Prepare

- Vendor Central brands need to start thinking about how to position a price increase if/when it’s needed. We should expect some margin % compress for each part of the supply chain: suppliers, brands, retailers – plus higher prices for consumers.

- Have HTC information ready on a per product basis in case questions come up about tariff impacts.

- Expect to explore new programs: MDDP Direct Import vs FBA, or Amazon GMM agreements to support higher costs in select scenarios.

- If you haven’t already, start considering Seller Central options. We know in most cases, Amazon Vendor Central will work with brands, but understand what a shift to 3P might mean for your margin if you can’t come to a VC agreement or it’s going too slow.

THE NEED FOR RETAIL PRICE INCREASES TO SUPPORT COST INCREASES AT AMAZON VENDOR CENTRAL (Tariff Impact)

The Goal: Increase price to share the impact of Tariff costs between manufacturers, retailers and consumers

With Tariffs impacting costs for most manufacturers, many are pushing cost and MSRP increases onto retailers, including Amazon and Walmart. The expectation is retail partners will accept the cost increase and raise retail prices to recoup some of the margin loss. But with Amazon and Walmart pricing off algorithms, this is rarely a fast or instantaneous process. This creates significant margin compression on Amazon and also upsets retailers who no longer have competitive retail prices.

How Amazon Chooses Retail Prices

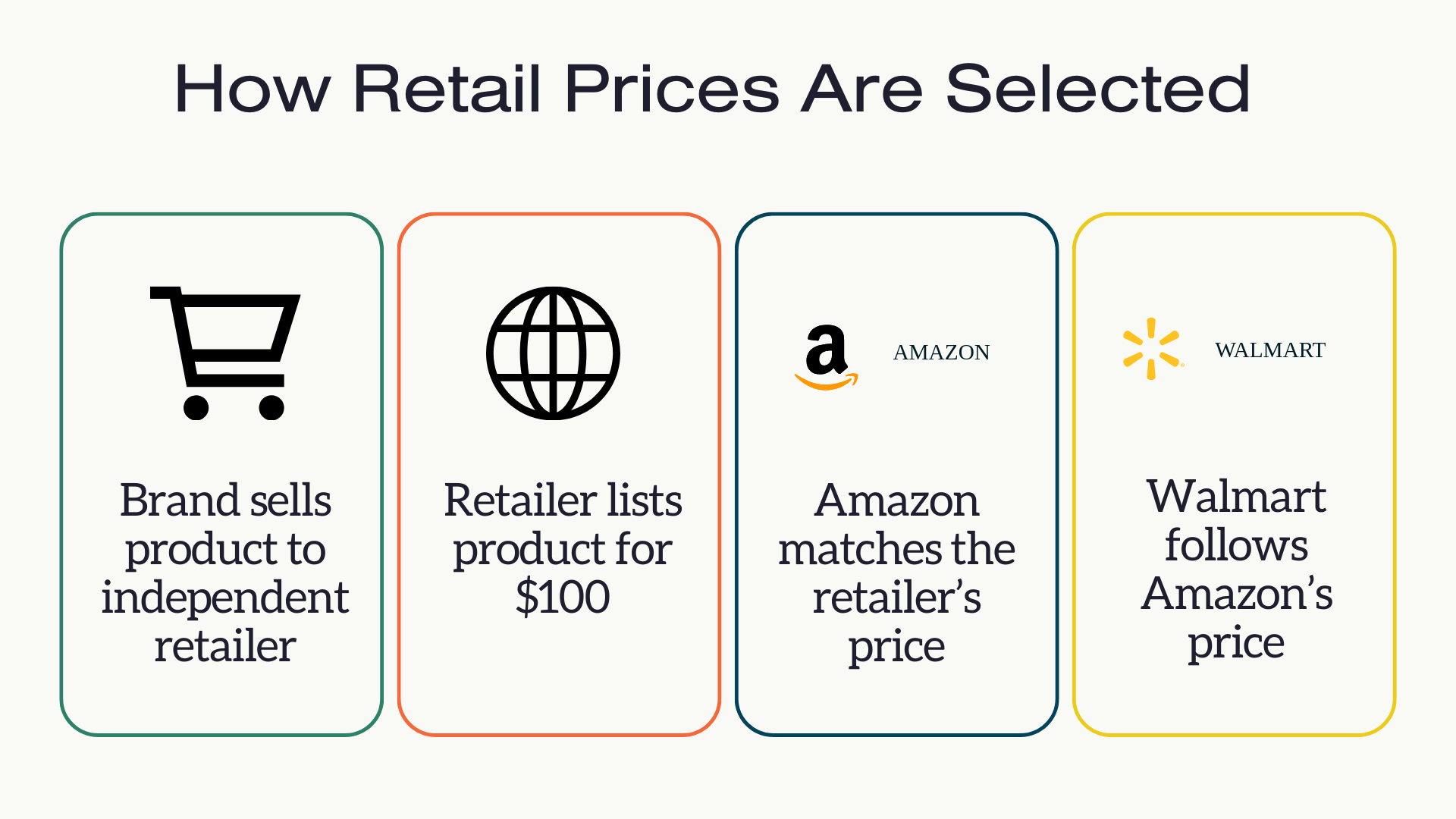

If you’re familiar with how Amazon and Walmart pick retail list prices, please move to the next section, otherwise here is a brief refresher of why price increases at retail for marketplaces like Amazon and Walmart are so challenging.

Amazon and Walmart both consider themselves price followers, using algorithms to generate competitive retail list prices based on pricing from 3P sellers on their respective sites – but also matching to external sites, including each other. This often creates sticky prices that quickly move lower but are difficult to move up. The reality is that the merchants at Amazon have little to no control over retail list price, and therefore price increases must be driven by an understanding of the algorithm.

An Example:

- Product A sells for $100 on Home Depot, Amazon, Walmart, and independent hardware store websites for all of 2024.

- Amazon and Walmart both match the retail list price at $100.

- The MSRP increases $25 in 2025 and Home Depot increases price to $125 but independent retail stores forget to change the price and it remains $100.

- Amazon matches the $100 price it found on the hardware store site, then Home Depot and Walmart follow, leaving the price at $100.

- Walmart and Home Depot are asked by the brand to raise the price and they do, but Amazon remains at $100.

- Without movement from Amazon, the other retailers eventually match, and the price remains locked at the original retail price.

The Problem with Amazon Price Increases

As brands look to push cost increases to Amazon in the coming weeks, Amazon will almost certainly point to margin compression that will result at the current retail price. Without a clear line of sight to increased retail pricing in conjunction with costs, Amazon will see margin degradation equivalent to costs. Margin, particularly margin %, has been a point of focus for many GLs at Amazon for the last 18 months and we don’t anticipate any changes in that direction. Even in the face of significant cost increases for suppliers, Amazon will likely push back hard on price increases that don’t come with equivalent retail increases to preserve margin.

How To Handle Price Increases

Manage Resellers and Enforce Retail Pricing Policies

Ideally, brands would already have an effective UPP and authorized reseller program in place that helps to actively manage pricing and who is selling their products online. Having a mechanism to manage pricing and assure only authorized dealers are receiving product is invaluable in a time of intense change. Read more about how the programs work and how to develop one.

For many brands, authorized reseller programs and MAP policies are impractical, especially for CPG or grocery products that are widely distributed. For those, other tactics around timing and Amazon GMM agreements may be necessary.

Lead with Price Increases to Other Retailers

Price changes take time to flow through, so plan to increase prices to other retailers before Amazon. Showing an increase in ASP (Average Selling Price) at the time of a cost increase request can greatly reduce pushback and increase chances of a smooth negotiation. In most cases, we suggest implementing price changes at most retailers 30-60 days before Amazon. And remember: because Amazon will follow price, within hours to a few days of other retailers increasing price, Amazon will follow and give you the green light to request a price increase.

Protect with an Amazon GMM Agreement

If an immediate price increase is needed without proof of a retail increase, Amazon is likely to ask for a guaranteed margin agreement. This is an agreement, for a set term, that obligates the seller to pay the difference between Amazon’s margin and the actual margin achieved, if Amazon’s margin is lower. The agreements can be written for an entire brand, a single ASIN, or group of ASINs, and have a set duration.

While we generally don’t like GMMs due to the brand bearing the full risk of price increases, it is a way to reduce Amazon’s risk and capture the price increase you may need. One tip: don’t accept a GMM agreement for the same % margin Amazon realized in 2024. Amazon shouldn’t expect the same % margin with tariff-driven price increases, and you certainly don’t want to be guaranteeing they will get it.

As so many look to push price increases this year, just remember how retail list price operates on Amazon and other marketplaces and be sure to plan accordingly.