Amazon, Walmart, and Target had overlapping tentpole sales events this July. In past years, marketplaces like Walmart would typically schedule their Prime Day rival event, Summer Deals, about a week before Amazon’s to capture buyers earlier. But this year, three major marketplaces ran events simultaneously, creating challenging questions like:

- Which brands should participate in which marketplace events? Should brands participate in all three?

- What does managing brand budget look like when deciding whether to run deals and platform-specific campaigns on more than one marketplace at the same time?

In this article, we’ll discuss results from the busy sales week, key trends we noticed, and where brands were successful.

Sales Results from Amazon Prime Day 2025

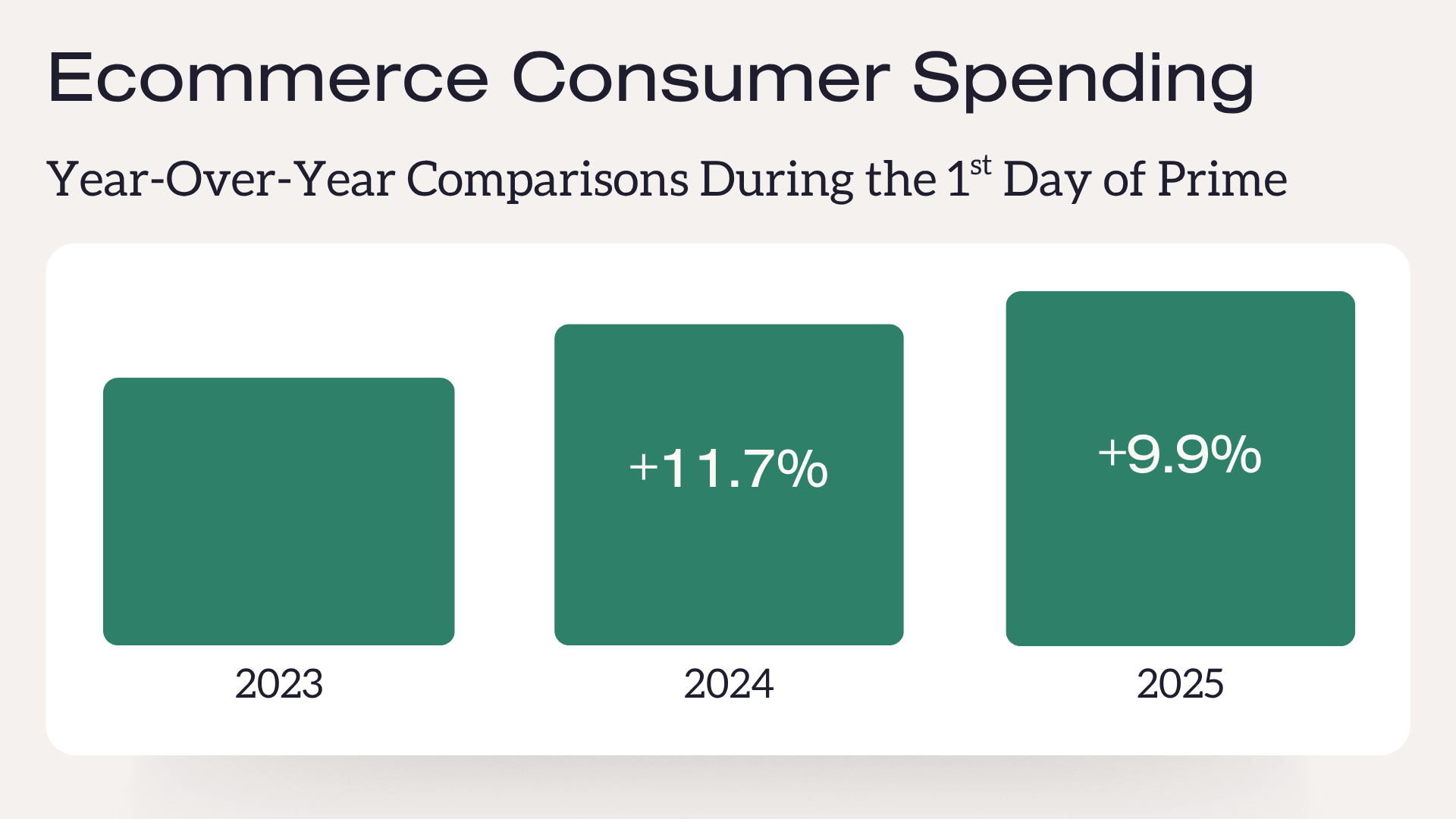

On the first day of Amazon Prime Week (July 8, 2025), online sales across U.S. retailers rose 9.9% year-over-year to $7.9 billion. In comparison, the first day of Prime Week last year brought in an 11.7% year-over-year increase to a total of $7.2 billion. Of course, this year, shoppers were likely more active on other marketplaces as well, helping contribute to that 9.9% growth.

As the week went on, Amazon Prime Day sales spiked 165% year over year compared to what would have been Prime Days 3 and 4 last year. As our team found in our reporting of Prime Day, it is most effective to compare last year’s Prime Day + 2 days following versus all of Prime Day this year to get an accurate 4 days vs 4 days year-over-year comparison. With that being said, we’ve also seen CPG brands report on Prime Day as last year vs the first 2 days of Prime this year (i.e. 2 days vs 2 days).

As the marketplace tentpole events concluded, U.S. ecommerce sales totaled $24.1 billion from July 8–11—a 30.3% YoY increase. This is the equivalent to two Black Fridays (Black Friday 2024 saw $10.8 billion in online spend). Of this total amount spent, Paid Search accounted for 28.5% of U.S. ecommerce sales during Amazon Prime Day, up 5.6% year-over-year.

Total ad spending over the four-day event rose 48% YoY, however average daily ad spending fell 26% YoY. To that point, we noticed that brands who didn’t promote saw zero lift in 2025. In previous years, many sellers would still see a significant sales lift solely based on the increase in traffic. As marketplaces like Amazon both increase the amount of ad placements and push sales events longer, brand investment in advertising becomes more crucial.

Amazon Prime Day vs Walmart Deals vs Target Circle Week 2025

Amazon, Target, and Walmart have not announced any specific sales figures regarding how well their marketplaces did throughout the busy week. However, Emarketer estimated that Amazon Prime Day brought in 60% of total spending, spreading the remaining 40% across other retailers, like Walmart and Target. Additionally, Numerator surveyed 5,000 Amazon Prime Day shoppers to uncover that 49% of them had already shopped or may shop the Walmart Deals Event while 35% mentioned the same regarding Target’s Circle Week. 32% of the surveyors said that they had not and did not plan on shopping any other Summer sales.

Despite not publicizing any specific sales figures, Amazon announced that 2025 was their best Prime Day to date. Adobe Analytics reporting also uncovered:

- Mobile was the dominant transaction channel during Prime Day, driving 53.2% of online sales

- Discounts across U.S. retailers were between 11% and 24%

- Apparel had the biggest discounts at 24% (compared with 20% last year), while electronics were at 23% (similar to last year)

Key Learnings from Prime Day 2025

Moving on from overall ecommerce sales, there were a few key themes that we noticed throughout the busy shopping week:

- Amazon did a better job catering the shopping experience to individual shoppers.

- The 4-day event did not drive significant (if any) additional sales vs the 2-day event.

- Brands who didn’t promote saw zero lift in 2025 (in previous years, we’d see a significant sales lift for brands who didn’t promote just due to increased traffic).

- The event seemed lack-luster, presumably due to having four days to shop and three different events happening all at once with Amazon, Target and Walmart all getting in on the action.

1. Amazon Improves Personalized Shopping

This year, Amazon did a better job catering the shopping experience to individual buyers. This is, in part, from the platform’s investment into stronger ad targeting options (like Amazon Marketing Cloud) as well as Amazon’s commitment to improving Rufus: the marketplace’s AI shopping assistant.

We have also continued to see Rufus become more active, accurate, and influential to shoppers on the Amazon platform. Now, it is available to all U.S. buyers, pulls product answers and information directly from detail pages, and even recommends specific products to purchase.

During Prime Day specifically, Rufus had prompts at-the-ready for shoppers who were keen on finding the best deals and even recommended specific product types without being given a prompt. Rufus also recommended sponsored listings that aligned with shoppers’ browsing and saved cart history.

2. Longer Amazon Prime Day Does Not Guarantee Higher Sales

With Amazon’s decision to shift Prime Day to four days this year (instead of two days like in years past), there was a huge question going into the event: would a longer event lead to higher sales?

Unfortunately for many brands, the answer was no. From what we’ve seen, the 4-day event did not drive significant (if any) additional sales vs the 2-day event.

We assume this lack of higher sales was largely due to consumer overload. Having three different tentpole events happening simultaneously (Target Circle Week, Walmart Deals Event, and Amazon Prime Day) made it difficult for consumers to prioritize which sales to shop. The result was lackluster sales compared to what many expected would be a much stronger event for brands who chose to participate.

3. Promotional Investment is No Longer Optional

In past years, even brands who chose not to participate in Amazon Prime Day would often still see a significant sales lift due to increased traffic on the marketplace. However, that pattern was not present this year. In 2025, brands who didn’t promote saw zero lift.

As a result, brands need to be prepared as we head into Q4, expecting Amazon’s next tentpole event: Prime Big Deal Days. Especially as we enter 2026, brands need to prepare for an increase in promotional investment – including deals and advertising campaigns – that will get their products in front of shoppers during peak periods.

4. Consumer Overwhelm from Marketplace Overlap

Although Amazon reported all-time sales during Prime Day 2025, the week looked very different to consumers who had to juggle different discount options across multiple marketplaces.

With Amazon specifically deciding to run a longer event this year, we saw slower decision-making from consumers. Sales slowed down during days 2 and 3 of the event as many shoppers were likely holding out to see if better deals became available. Finally, there was a burst of sales on day 4 (the last day) of Prime, with many finally locking in their carts to avoid discounts slipping away.

Consumers still seem to be waiting for the best possible deals before purchasing, even if that means waiting until the last minute to secure them. But, with all three major marketplaces having platform-specific sales running simultaneously, consumers were slower to make decisions, likely overwhelmed with all the discounts available.

It was smart for Walmart and Target to host their promotional events at the same time as Amazon, driving consumers onto their marketplaces instead. However, the overlap also likely muddied sales across all three platforms. If Walmart was the only platform who had discounts running that week, the marketplace could’ve seen a lot more transactions take place (without having to be in competition with Amazon Prime Day and Target Circle Week).

What Went Well During Prime Day 2025?

During Prime Day, we saw success in the following areas:

Pre-Event Strategies

- Launching deals early captured early shoppers while dealing with less competition and giving brands more time to be ready for the event.

- Creating a dedicated Deals page on brand stores specifically for the event made for a seamless, branded shopping experience.

- Investing in targeted advertising campaigns and comprehensive product content was key for resonating with Amazon’s Rufus as we headed into Prime Day.

Maintaining Visibility During Prime Day

- Traffic spiked on the first and last days of the event (mid-event tailed off a bit). There has typically been a big boost in the past as Prime Day comes to an end.

- Ramping up ad campaigns once deals went live helped push traffic to high-priority products.

- Shifting towards a more aggressive top-of-search model allowed visibility to capture new-to-brand customers. These placements were more effectively achieved when deep discounts or low ASP were present.

- Reducing spend in branded campaigns allowed our brands to focus on reaching NTB shoppers through generic and competitor targeting. However, brands worried about low branded SOV launched branded SB campaigns to reduce competitor presence on key branded terms.

Post-Event Checklist

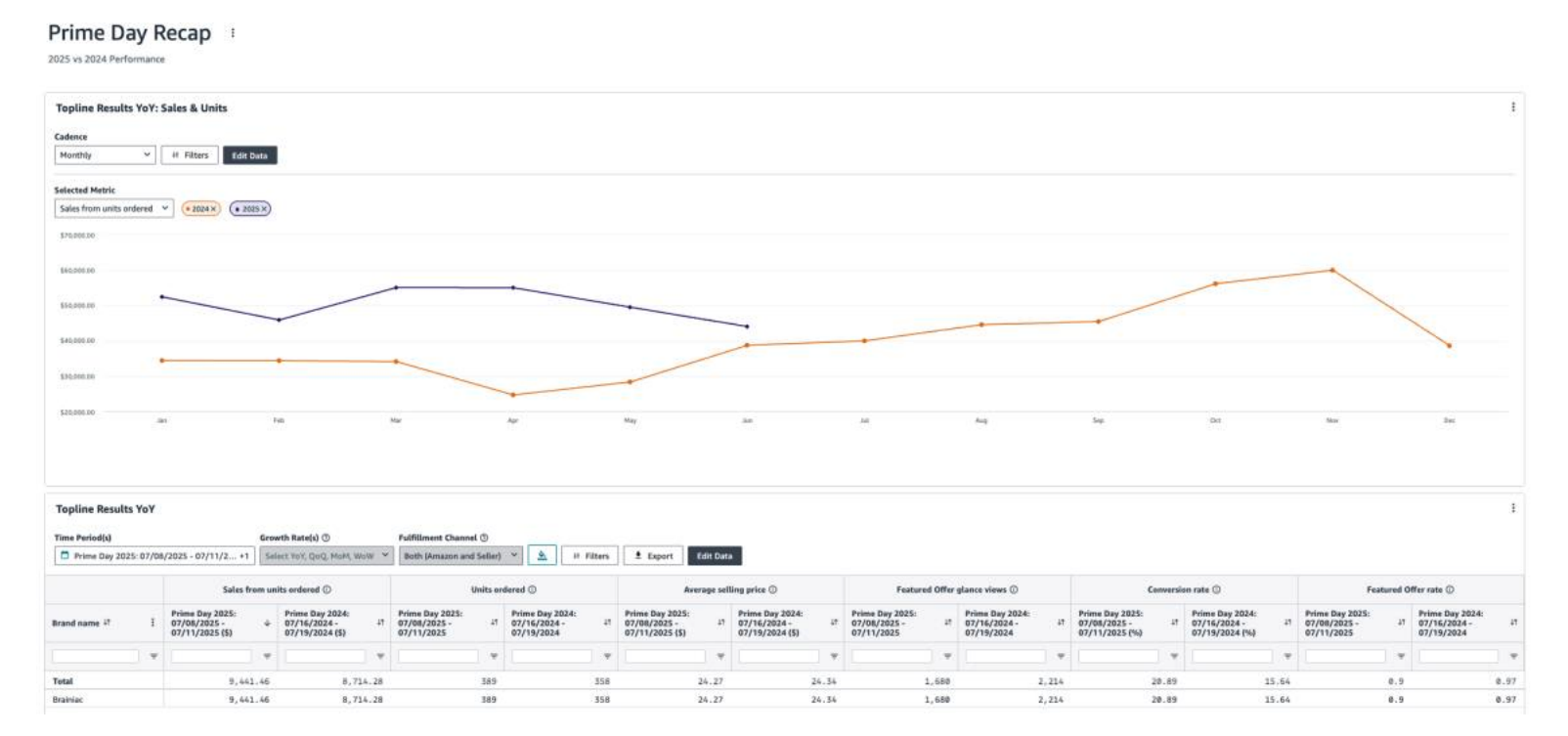

- Review ad campaigns, ASIN-level sales, and overall sales. This data can be pulled manually or through a product analysis dashboard for easy WoW or MoM reporting.

- Launch re-order coupons and send review request follow-up emails to those who purchased.

- Run retargeting ads and utilize Brand Tailored Promotions to capture attention from shoppers who didn’t purchase.

Also keep in mind that your investment (eg: deals & ad campaigns) leading into and out of the event is nearly as important as participation in the event itself. Brands who chose not to participate were still able to leverage promotions before and after the shopping period to gain visibility and sales.

Conclusion

July 2025 was a busy time for ecommerce with Amazon Prime Day, Walmart Deals, and Target Circle Week commencing simultaneously. Despite Amazon saying that this was their best Prime Day ever, the result was not impressive for many brands. However, we were able to uncover some key learnings about visibility and the value or promotions during the event which should be leveraged as a point of reference as we head into the Q4 BF/CM shopping season.