Article

Recap of Amazon Cyber 5 Marketing Strategy (Pacvue Report)

In our previous analysis of the Amazon Turkey 12 (T12) period, we explored the broader sales landscape, noting how AI adoption and extended promotional windows led to record-breaking ecommerce results. However, high-level sales figures often obscure the tactical reality on the ground for advertisers. While the sales totals tell us what happened, they don’t necessarily tell us how it happened—or at what cost.

To bridge that gap, we analyzed the newly released 2025 Pacvue Cyber 5 Benchmark Report. By combining Pacvue’s extensive data across thousands of advertisers with our own internal performance notes, we are breaking down the Cyber 5 advertising results that actually matter. Keep reading for our Amazon marketing strategy analysis focusing on efficiency, cost, and shifts in consumer behavior that defined the 2025 holiday peak.

The Elephant in the Room: Traffic vs Efficiency

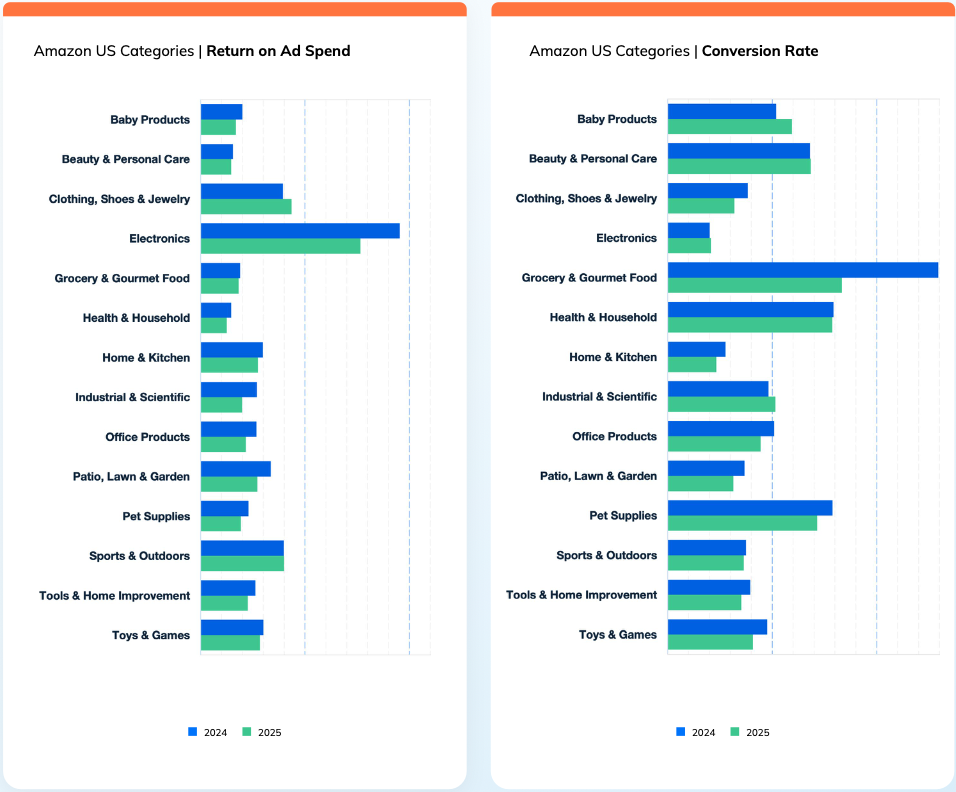

When reviewing Amazon marketing report data, it is easy to get lost in positive year-over-year (YoY) percentages regarding Return on Ad Spend (ROAS) or Conversion Rate (CVR). However, our internal analysis highlights a crucial context that raw rates can hide: traffic volume.

While spend and sales figures increased, many metrics point toward traffic being lower than expected for the event in several key categories. This suggests that the Cyber Week Black Friday period was less about capturing a flood of new, casual browsers and more about winning the battle for high-intent shoppers who already knew what they wanted.

Pacvue’s data supports this efficiency-over-volume narrative. For example, while Amazon Black Friday ad spend increased, efficiency became harder to maintain as the event wore on. Sustainable growth this year depended heavily on smarter targeting rather than budget scale alone. Brands that treated Cyber 5 as a volume game likely saw diminishing returns, while those who optimized for high-intent conversion—specifically on Day 1—saw outsized success.

Cyber 5 Amazon Advertising Strategy: Which Days Worked Best?

One of the most distinct trends from the 2025 data was the performance gap between the beginning of T12 to Black Friday and Cyber Monday.

T12 & Black Friday Amazon Ads Were the High-Intent Winners

Our marketing strategists uncovered that the first day of T12 (11/20/25) was vital. Shoppers have learned that discounts are unlikely to drop further as the T12 period progresses. Consequently, CVR was high and Cost-Per-Click (CPC) was comparatively manageable early in the event, leading to the highest ROAS potential of the week.

Pacvue’s report confirms this trend continued through Black Friday. On Amazon, Sponsored Brands ROAS surged +25.2% on Black Friday YoY. Even on Target, advertisers saw a 28% increase in ROAS on Black Friday despite lower spend, driven by efficient traffic.

The takeaway for future T12 and Black Friday marketing strategies is clear: the early bird gets the ROAS. Our campaigns were prepped to capitalize on this early intent, and the data proves that front-loading budget was the correct move.

Cyber Monday: The Budget Dump

In contrast, Cyber Monday proved to be a dud for ad efficiency compared to Black Friday. We observed lower CVR and higher CPC on Cyber Monday. This phenomenon is likely caused by a few factors:

- Shoppers not waiting for better deals

- Softer-than-expected traffic (fewer shoppers = fewer available top-of-search (ToS) clicks = price will go up

- Marketers with spare budget dumping spend at the finish line to hit targets.

This aggressive spending on Monday drove up costs on traffic that were less likely to convert. For instance, Amazon EU data showed that CPC rose significantly on Cyber Monday while conversion rates softened. In the U.S., while Cyber Monday is still a massive sales day, the Amazon Black Friday and Cyber Monday dynamic has shifted; Friday is for efficiency, and Monday is becoming a battleground of diminishing returns.

Category Benchmarks: Essentials vs Discretionary

The “Split Consumer Economy” we discussed in our general sales article played out clearly in the advertising metrics.

- Essentials (Baby, Pet, Health): These categories saw heavy pressure. In Pet Supplies and Baby Products, CPCs increased as brands fought for share of voice. However, the conversion rates justified the cost. Baby Products was one of the few categories to see a YoY increase in CVR, according to Pacvue, which lines up with our clients in the space who fared the best out of all our brands in terms of hitting sales goals.

- Discretionary (Toys, Electronics): Interestingly, categories like Toys & Games saw reduced pressure as advertisers shifted spend toward essentials. Heavily influenced by AI-driven search that simplifies complex specs, electronics remained the most profitable category for advertisers, delivering an impressive ROAS of $15.32 on Black Friday.

This data underscores the need for Amazon sellers’ marketing strategy to be category-specific. A one-size-fits-all approach to Black Friday strategies would have failed in 2025, as the advertising dynamic for a toy brand was fundamentally different from that of a supplement brand.

- Toys & Games: ROAS of $6.05 on Black Friday and $5.29 on Cyber Monday 2025

- Beauty & Personal Care: ROAS of $3.15 and CVR of 28.23% on Black Friday 2025

- Electronics: ROAS of $15.32 on Black Friday 2025

Brandwoven Cyber 5 Amazon Marketing Strategy & Client Results

Black Friday and Cyber Monday Amazon Advertising Strategy

Throughout Cyber 5 promotional window, we applied the following marketing tactics to keep our brands on track for their peak season sales goals:

- Our strategy revolved around pushing products that showed the deal badge.

- Throughout T12, we adjusted all creative banners consistently if we saw products shift in inventory.

- We utilized video ads to appear within search results to cover more of the page when scrolling.

- Products that were low on inventory had ads adjusted to run at a slower pace to still provide support without running through inventory.

- Sponsored Brand campaigns were enabled for additional coverage.

- We shifted targeting to use current and historically top-converting keywords for all promotional campaigns, leading to increased CTRs and improved conversion rates while holding efficiency.

- We kept spend focused on competitor targets where our brands were winning Overall Pick badges for competitor terms, leading to increased click-through rates and improved conversion rates and sales.

- Target ToS placements due to their high CVR and ability to grab New-to-Brand (NTB) shoppers (premium clicks).

- Ensure that Black Friday and Cyber Monday deals that are running are available to all shoppers and not just Amazon Prime-exclusive to capture the influx of new shoppers.

- Be incredibly careful about pricing discounts across platforms. We know that if Amazon flags a product as having a lower price on another platform, the marketplace’s deal badging is lost for the remainder of the event.

Cyber 5 Marketing Reports from Our Amazon Client Results

While the industry benchmarks provide a baseline, our tailored approach to Black Friday and Cyber Monday ads for our clients showcase real-world seller marketing strategies in action:

- Pet Brand: Facing increased CPCs but an increased budget, we were able to see significant increases in sales, resulting in KPI growth:

- Sales +233%

- Conversion Rates +71%

- Clicks +114%

- Hunting Brand: The brand saw a substantial surge in performance with traffic expanding meaningfully. Overall, the account captured major demand with strong visibility and volume growth.

- Sales +105% PoP

- Impressions +274%

- Clicks +246%

- Apparel Brand: Overall, the account saw efficient spend, strong engagement, and meaningful YoY growth throughout the full event period.

- Ad Sales +62% YoY

- Conversion Rates +14.9%

- Clicks +52%

- Grocery Brand: With proper targeting and a consistent hands-on approach we adjusted ads to see an increase in ad sales while holding the client’s ROAS goal. The brand saw increases to Amazon traffic based on clicks:

- Ad Sales +7% YoY

- Clicks +39% YoY

Despite these positive results, we didn’t see the same performance across the board. Some brands faced inventory issues, lower budgets than previous years, and naturally were in competitive categories where CPC skyrocketed during the event. Additionally, some brands chose not to push deals on the majority of their products resulting in minimal PoP (period-over-period) or YoY changes. In cases like these, the limited promotional products were pushed to increase visibility while non-promotional products were set with lowered bids in anticipation for increased holiday traffic. Overall, performance was largely driven by items on promo which brought in the strongest mix of traffic and orders.

By planning far in advance and maintaining constant communication with our clients during the promotional window, our team was able to move quickly, adjust strategies as needed, and drive growth across various KPIs for many of our clients.

Conclusion: Planning for 2026

Following performance peaks, we’ll now see CPC and sales level into steady post-Black Friday event strength.

The 2025 Pacvue Cyber 5 Benchmark Report and our internal performance data make one thing clear: the era of “set it and forget it” for Black Friday marketing strategy is over. The winning formula for 2025 involved front-loading budgets to capture early T12 and Black Friday efficiency and navigating a traffic-constrained environment with precision bidding.

As we look toward 2026, the integration of AI in search and the shifting dynamics between ad formats will continue to evolve. Brands cannot rely on last year’s playbook. You need a partner who looks past the vanity metrics to understand the “why” behind the performance.