As we move through 2025, Amazon marketplace dynamics have shifted dramatically from the volatile early months to what we now recognize as a stabilized “new normal.” While tariff uncertainties have settled and budgets can finally be locked in, brands face new challenges: elevated COGS, price-sensitive consumers, and intensifying competition for every sale.

For Amazon brands looking to finish 2025 strong, success will depend on adapting strategies to these evolved marketplace conditions. Here’s how leading brands are positioning themselves for Q4 success and sustainable growth into 2026.

U.S. Tariffs & 2025 Consumer Spending Trends

At the start of the year, we had been bracing for the worst with the introduction of tariffs – like many others – anticipating decreased consumer spending. We initially anticipated significant market disruption, but conditions stabilized more quickly than expected, allowing businesses to pivot from crisis management in late Q1 and early Q2 to strategic planning going into Q4. Consumer spending still appears to be down, making competition for every sale more challenging. However, the economy is stable enough to chart a clear path forward for brands through the rest of 2025.

As we approach the holiday season, we anticipate consumer spending will still be down year-over-year, despite forecasts suggesting otherwise, as these forecasts are often lagging indicators, and we see consumer behavior on the Amazon platform before it shows up in economic metrics.

Vendor to Seller Central Transitions

We’ve also observed brands transitioning from 1P (Amazon’s Vendor Central model where Amazon buys inventory directly) to 3P (Amazon’s Seller Central model where brands maintain control over pricing and inventory). For some, this has looked like the brand opening their own Seller Central account while others have begun to use resellers to reach the Amazon consumer. This shift has largely been due to Amazon’s unwillingness to negotiate on pricing or eroding margins in the VC model for both Amazon and the brand.

Current Amazon Environment

We’re observing some conflicted signals regarding Amazon’s performance. Amazon itself reported its best Prime Day ever, but for many brands, the general lift was rather lackluster and not universally experienced. This observation was also corroborated by discussions with other agencies.

Overall, the rapid growth that Amazon experienced from 2018-2022 appears to be slowing. While Amazon continues to report strong numbers, the overall growth rate is decelerating.

Since 2023, competition on Amazon has normalized. To some extent, this is beneficial as the growth we provide for brands is more representative of our capabilities, but it also means that the actions we take on behalf of Amazon brands are more critical as growth requires taking share vs simply growing along with the platform itself. We view this not as a cause for nervousness, as Amazon remains a very strong platform and a successful company, but rather as an area to closely monitor.

New Report: US Consumer Spending Trends in 2025

These marketplace shifts align with broader industry data. A recent CommerceIQ report, provides valuable insights into the broader marketplace landscape that can help us further assist brands.

Key findings from the 2025 trends report indicate:

- Conversion rate optimization is outgrowing traffic growth on Amazon (+6.5% YoY vs. +2.2% YoY) with a higher likelihood to convert in Q2.

- Customers are exhibiting price sensitivity with ASP (Average Selling Price) decreasing by -2.6% YoY.

- While strong Prime Day performance was observed for brands that ran promotions, there was no overall “halo effect” as seen in previous years.

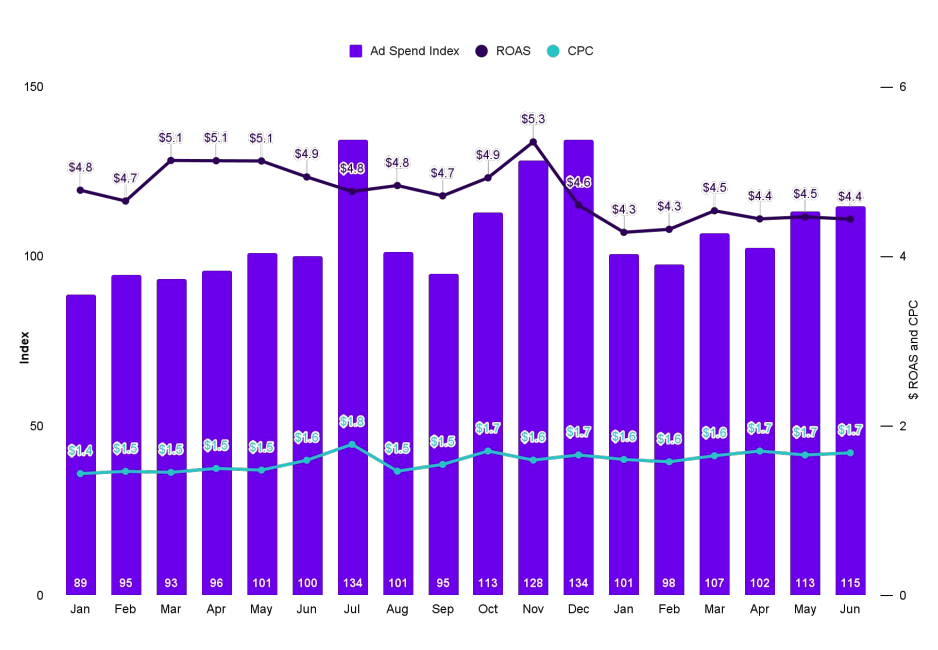

- Ad spend increased +10.3% YoY and ROAS decreased -11.8% YoY. This suggests brands are investing more in visibility, but with heightened competition, this could imply an impact on sales. Our marketing team is heavily focused on optimization to counteract this trend.

Based on these findings, we are influencing our clients’ strategies in several ways:

- With traffic reducing and conversion rates increasing, conversion optimization must be at the forefront of all our efforts. This includes focusing on:

- Better images, A+ Content, and reviews: High-conversion product imagery that addresses key buyer concerns and proactive review generation strategies continue to be crucial for Amazon brand success.

- Considering bundles or B2B bulk buys if strategically appropriate, in addition to typical promotional discounts.

- It’s essential to build out robust promotional strategies, even for brands who typically don’t use them, as customer behavior is clearly shifting towards relying on promotions for decision-making.

- Regarding price sensitivity, we are engaging with brands about their assortment strategies, especially if they exclusively offer premium-level products, as this can be critical. However, this approach won’t be suitable for every company and it’s a decision we can evaluate and discuss together to uncover the best path forward.

- As competition continues to intensify, we are prioritizing brand differentiation by building out digital merchandising, advertising, and off-Amazon strategies.

- Diversification is key; while Amazon remains a crucial player, exploring omni-channel retail and other marketplaces like Walmart and Target will be vital for continued growth.

Prime Big Deal Days 2025: Strategy Preparation

Amazon has already begun contacting Vendor Central brands concerning promotions for Prime Big Deal Days. We are advising our brand partners to start developing their strategies for this event now. The focus should be on seasonally relevant products or those with excess inventory.

While Prime Big Deal Days might not be the right fit for every brand, it presents a significant opportunity for brands leading into the holiday season. We are enthusiastic about the upcoming holiday period and are planning for increased product participation, positioning our brand partners for maximum impact.

Where Marketplace Strategy & Management is Heading

The marketplace environment demands constant strategic adaptation. As cost scrutiny intensifies, successful marketplace teams and agencies like ours must evolve to maintain competitive advantage.

Key shifts reshaping marketplace strategy include:

- Strategic Platform Evaluation: Brands are conducting deeper analyses before making platform decisions, evaluating long-term scalability.

- Go-To-Market Evolution: We’re witnessing fundamental changes in how brands approach marketplace entry and growth.

- Partnership-Driven Growth: The most successful marketplace strategies now center on collaborative partnerships between brands and providers that can quickly adapt to platform changes and consumer behavior shifts.

The brands that will thrive through 2026 are those that embrace change as a competitive advantage, working with partners who can anticipate and adapt to marketplace evolution before it impacts performance.

Adapting to Consumer Spending Trends in 2025 & 2026

The marketplace evolution of 2025 has separated strategic brands from reactive ones. While challenges like elevated costs and increased competition persist, the brands thriving today are those that have embraced conversion optimization, developed sophisticated promotional strategies, and diversified beyond Amazon’s ecosystem.

As we head into Q4 and begin planning for 2026, the opportunity lies not just in adapting to these changes, but in getting ahead of them. The brands that invest now in comprehensive marketplace strategies – from Prime Big Deal Days execution to omni-channel expansion – will be best positioned to capitalize on the holiday season and maintain momentum in the new year.

At Brandwoven, we’ve navigated these shifts alongside our client partners, helping them navigate this “new normal”. Our deep understanding of evolving marketplace dynamics positions us to help your brand capture its share of growth in this increasingly competitive landscape.

Ready to adapt your strategy for Q4 success and beyond? Let’s discuss how these marketplace shifts specifically impact your brand and develop a customized approach for sustainable growth.