Amazon Prime Big Deal Days 2025 took place on October 7-8, delivering mixed results that reveal relevant insights as we head into the holiday season.

We analyzed external tech partner data, ecommerce industry reports, and our own proprietary performance metrics to provide a comprehensive recap on what happed during the Fall Prime event and share guidance on how to utilize these learnings heading into the holiday sales period.

Event Overview: While Prime Big Deal Days 2025 generated strategic value for Amazon through retail media investment and shopper engagement, pure sales performance varied significantly across categories and price points.

Pre-Event Advertising & Limited Consumer Awareness

Minimal Amazon Promotion Created Awareness Gaps

Our team noticed a notable trend leading into the event: Amazon conducted minimal advertising for Prime Big Deal Days this year. We first identified this pattern in mid-September when the sales event dates were announced. This limited promotion persisted as we got closer to the event; our team only recalled the occasional Amazon email about the upcoming promotion (which, from a consumer point of view, would only be helpful if one was already on Amazon’s email list). Finally, on October 7 (the first day of Prime Big Deal Days) members on our team noted seeing tv commercials promoting the sales event, but this advertising strategy merely pushed urgency rather than early holiday shopping as the event had often done in years’ past. This lack of event promotion on Amazon’s end likely suppressed consumer engagement and, as we’ll dive into more below, many shoppers were not even unaware of the event discounts.

Brandwoven’s Assessment of Prime Big Deal Days 2025

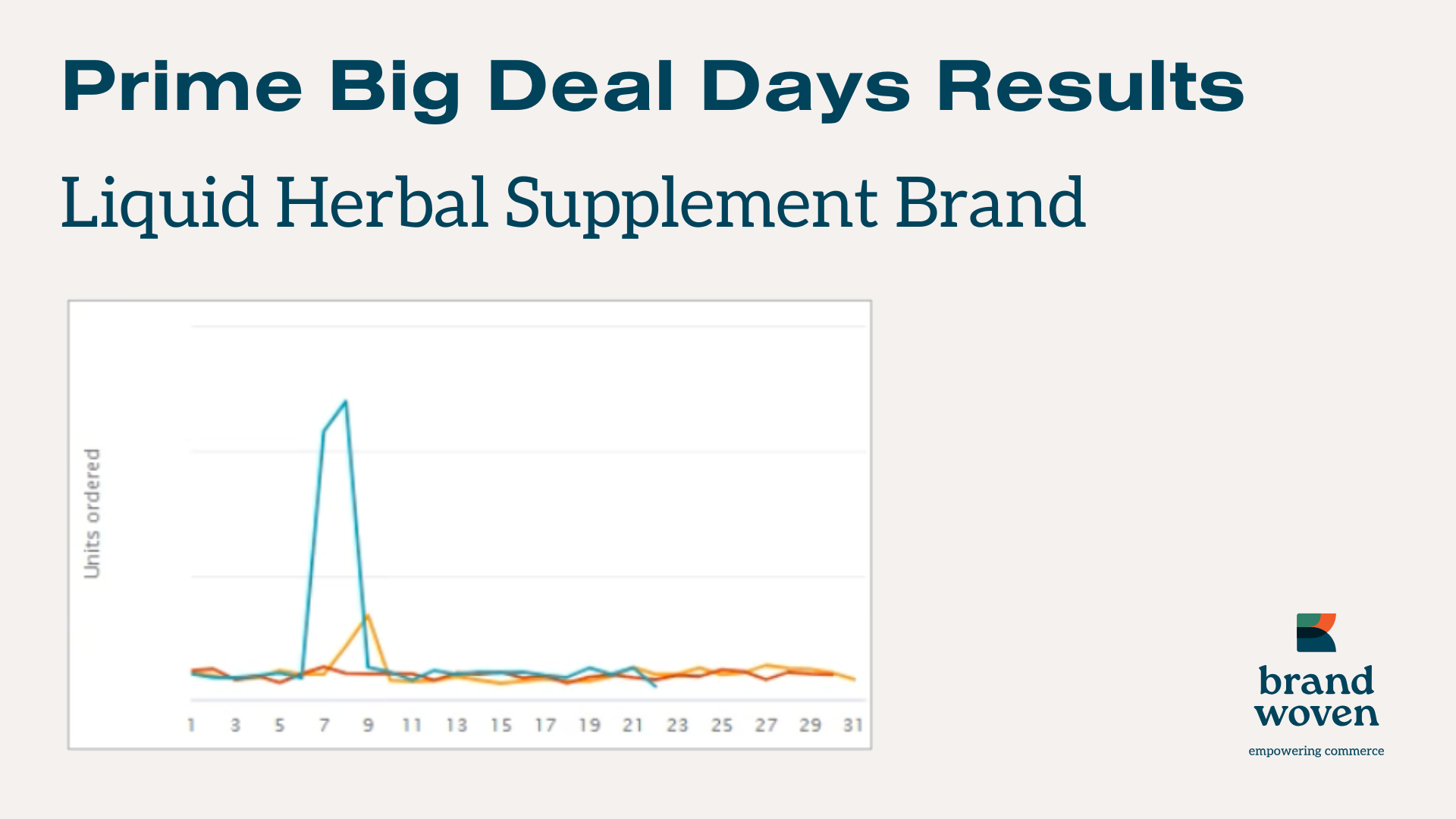

While the event delivered value for Amazon, brand-level results were largely underwhelming. However, we had massive success when one of our clients, a large liquid herbal supplement brand, demonstrated how an aggressive discount strategy combined with targeted advertising drove exceptional results during recent tentpole events (both July and October Prime Day).

Client Performance Breakdown

Promotional Strategy: 30% off formulas (excluding bundles) and 50% off powders

Results Achieved:

- +286% year-over-year sales increase

- Outperformed July Prime Day in both sales volume and efficiency

- 2.54 Total ROAS (across all advertising channels)

- 1.22 ROI

Industry Analysis of Amazon Prime Big Deal Days 2025

External reports from our technology partners and ecommerce outlets painted a nuanced picture of Prime Big Deal Days performance, with strong sales in necessity categories but underwhelming results elsewhere.

Consumer Behavior Patterns

Necessity-Driven Purchasing: Shoppers prioritized necessities over gifts. Deal-driven volume successfully captured orders in value categories including Grocery and Health & Personal Care.

Deal Satisfaction Remained High: 58% of shoppers reported being extremely or very satisfied with deals offered, with only 3% expressing dissatisfaction.

Awareness vs Promotion Disconnect: Despite limited Amazon advertising, 90% of Prime Big Deal Days verified buyers that were surveyed noted they were aware of the event, with 83% of them shopping specifically for the sales. This proves that most of those who shopped the sale knew about it, but because of the lack of advertising on Amazon’s end, we don’t know how many of these shoppers knew about the event beforehand versus saw day-of promotion and decided to jump on the sales.

In the past, there have been pre-roll ads launched in the Amazon mobile app leading up to these tentpole sales events to help with building shopper enthusiasm and engagement. However, as we’ve also seen in years past, this tactic usually killing sales leading up to the event (as consumers hold off on shopping knowing that bigger discounts are right around the corner). This year, Amazon doing less promotion leading up to Prime Big Deal Days was likely intentional as to avoid killing conversions leading up to the event – especially since Prime Big Deal Days lands near Q3 end.

Spending Habits:

- Average Order Value (AOV) of $45.42 (with 44% of orders under $20)

- Average household spend of $104.69 (with 14% spending more than $200)

Category Performance:

- Grocery (37.9%) and Beauty (33.0%) saw the highest category-level increases in search volume. Grocery also gained the most YoY units (21.8%).

- Beauty & cosmetics (22%) and Tools & Home Improvement (9%) maintained elevated demand despite higher pricing.

- Apparel & shoes (26%) and household essentials (26%) dominated Prime Big Deal Days with the strongest sales performance overall. As mentioned earlier, many shoppers took advantage of Prime Big Deal Days to stock up on everyday items rather than gifts.

- Toys & Video Games (14%) saw massive order increases driven by bundle strategies.

- Consumer Electronics accounted for 13% of purchases during Prime Big Deal Days, the same as during holiday 2024.

Economic Headwinds Shaped Decision-Making

Tariffs have largely impacted marketplace performance this year and consumer caution remained prevalent throughout Prime Big Deal Days:

- 48% of shoppers reported tariffs impacted purchase decisions

- 29% limited spending due to economic climate concerns

- 28% cited inflation/cost of living as purchase barriers

This consumer caution contributed to lower high-value purchases, particularly in discretionary categories like Consumer Electronics.

Purchase Motivation Split Between Planning and Impulse

The event drove both planned and spontaneous purchases:

- 41% planned purchases in advance

- 38% made impulse buying decisions

- 21% reported a mix of both approaches

Post-Event Retention & Data-Driven Targeting

Converting short-term deal hunters into repeat customers builds long-term value. Brands who participated in Prime Big Deal Days should implement post-event follow-up strategies based on audience behavior. Here are some strategies to test out:

Segment Your Audience

Use Brand Tailored Promotions to target:

- Repeat Customers: Provide exclusive access to new products or offer loyalty bundle deals.

- Recent Customers: Upsell by encouraging them to try complementary products or accessories (eg: if someone bought a coffee maker, offer a discount on coffee pods).

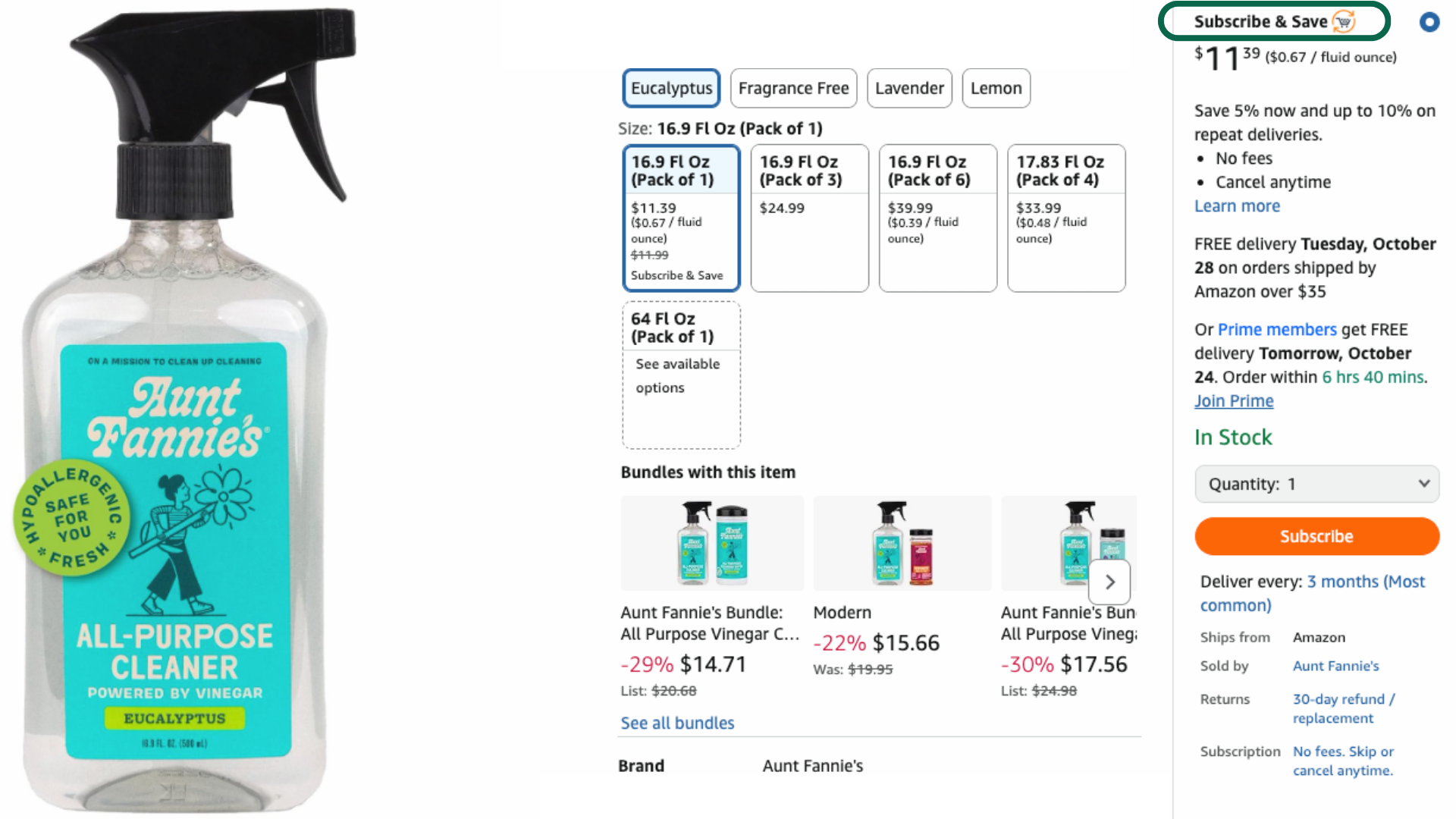

Use Subscribe & Save

Encourage repeat purchases by offering discounts through Amazon’s Subscribe & Save program; especially relevant for CPG products like cleaning or consumables.

Request Reviews

Increasing your (positive) review count is extremely important on Amazon, so taking advantage of this immediately after sales spikes is crucial.

One way to do this is by sending follow-up emails to customers who purchased, requesting a product review.

Another tip in supporting positive reviews is making sure to use the “Contact Customer” function for reviews received that are less than or equal to 3 stars in Seller Central.

Prime Big Deal Days Performance & Holiday 2025 Forecasting

The dynamics observed during Prime Big Deal Days in October provide some insights into consumer shopping behavior that we may continue to see through the holiday season (Turkey 12 through Christmas).

Category-Specific Participation

Not all brands benefit equally from tentpole events. We’ve known this for a while as some brands can’t offer big discounts due to tight margins or their product category just isn’t seasonally relevant as consumers aren’t gifting their products. Participation decisions should be driven by product category, price point, and competitive positioning rather than assumption that presence equals performance.

Anticipate the Shift to Gifting

Prime Big Deal Days sales were largely driven by necessity purchases and value-seeking behavior. As we move into November and December, we’ll likely continue to see this trend alongside a greater consumer investment in higher price point gift purchases (especially during Black Friday/Cyber Monday).

For many brands, it’s too late in the season to shift their holiday promotional strategy, but we can still use the learnings from Fall Prime Day to forecast what consumer behavior might look like during the holiday season.

Retail Media Investment

Tentpole events like Prime Big Deal Days generate high-intent traffic. Brands that increased advertising spend during the sales event were more likely to capture customers actively seeking deals. Again, this is something we’ve seen the past couple of years especially (as Amazon strongly pushes products with active deals during its sales events), with Prime Big Deal Days serving as another reminder of this crucial promotional investment when competing for visibility and sales.

Partner With Strategic Amazon Marketplace Experts

Brandwoven’s Amazon agency team prioritizes an adaptive approach to driving measurable results through turbulent times. This year especially, brands navigating selling on Amazon have dealt with an array of challenges, one of which is shifts in consumer spending habits (which will likely continue through end-of-year).

Connect with our team to talk through your brand’s specific challenges and let’s build an action plan that will drive growth for your brand into 2026.