Amazon has grown to be a fundamental element of selling products online but has also drastically changed the accessibility of data beyond the confines of its platform. Now, with the introduction of Amazon Buy With Prime, brands have a new opportunity to capture consumer data and build brand loyalists.

What is Buy With Prime?

Buy With Prime allows brands to leverage Amazon’s fulfillment network and payment system to enhance their direct-to-consumer (D2C) website. By integrating Buy With Prime on their ecommerce website, a brand can offer its customers the trusted and seamless Amazon Prime shopping experience – including fast shipping and a secure checkout – directly through their own website.

How Does Buy With Prime Work?

Buy with Prime enables brands to maximize their return on investment (ROI) by:

- Improving customer acquisition

- Enhancing conversion rates

- Gaining direct access to Amazon shoppers for remarketing efforts

It helps businesses grow strategically by tapping into Amazon’s vast infrastructure while maintaining control over their D2C presence. Importantly, it also enables them access to previous Amazon shoppers who purchased their products, driving them to their own D2C website. This strategy allows brands to strengthen connections with previous Amazon customers. It benefits businesses looking to improve conversion rates, retain customers, and use Amazon’s ad targeting capabilities to drive traffic efficiently to their D2C website.

Which Brands Should Use Buy With Prime?

The Buy With Prime program is ideal for brands that sell on Amazon and have a D2C website. While having your products sold on Amazon is not a requirement, having a D2C ecommerce website is a requirement to leverage this service.

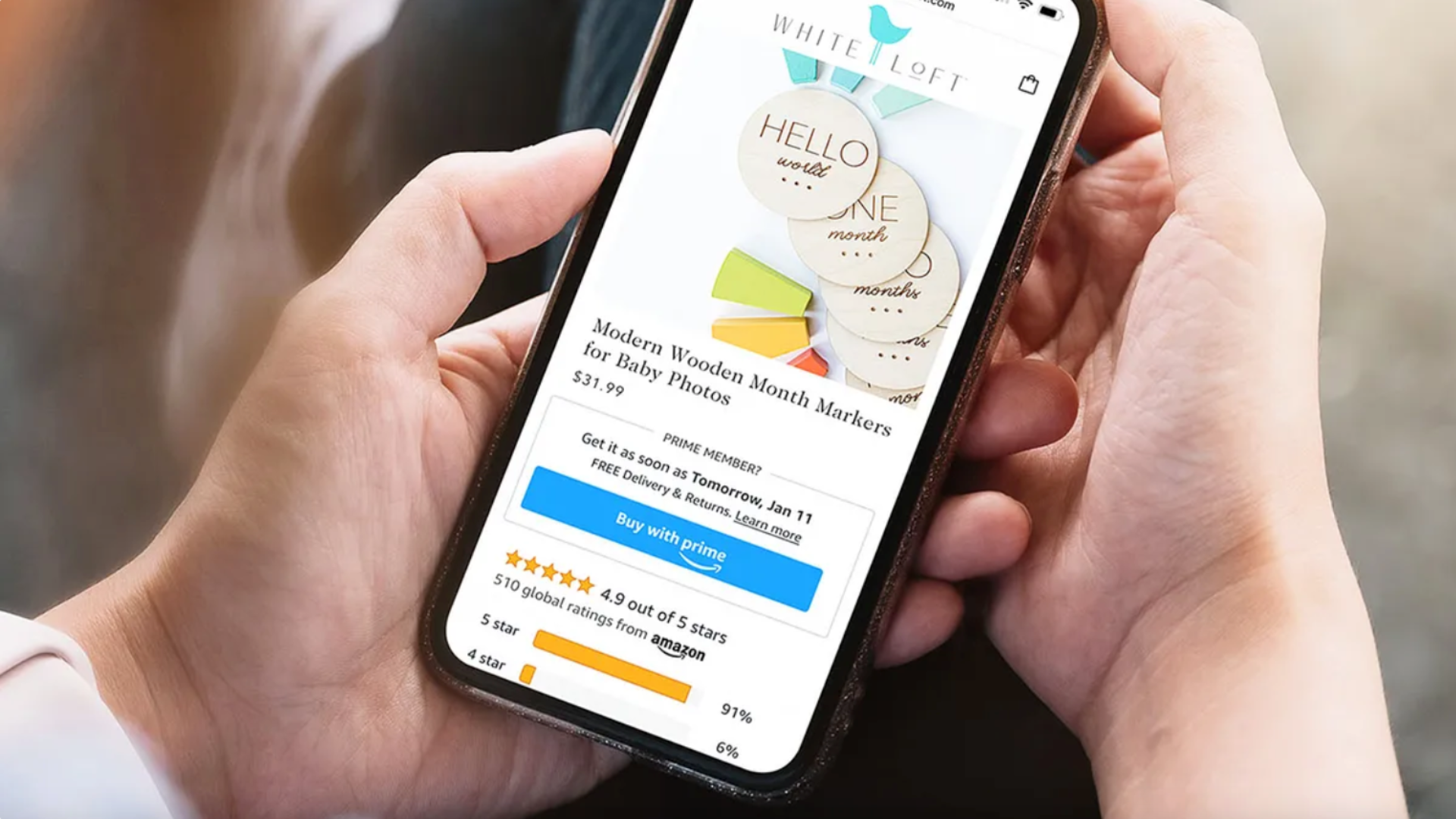

Image Source: https://www.cnet.com/news/amazons-buy-with-prime-extends-to-more-sites-in-the-us/

Why Buy With Prime is a Game-Changer

Amazon has made previous attempts to provide payment and fulfillment services to retailers outside of their marketplace. Similarly, there are many service providers regarding payment and fulfillment services. However, what makes Buy With Prime compelling (and represents a significant shift in Amazon’s strategy) is how it has been bundled as a single offering that truly provides the Prime shopper experience. Most importantly, Buy With Prime unlocks the ability for brands to target their ad campaigns using Amazon first party purchase data to efficiently direct Amazon shoppers to their own D2C website via Amazon DSP ad campaigns.

Prior iterations of Buy With Prime, such as “Amazon Payments” and “Pay With Amazon” (now commonly known as “Amazon Pay”), were expensive for brands and represented a risk: they reminded shoppers at checkout on D2C websites to check Amazon for the product. Given many brands’ D2C site ship speeds, that was a valid concern but Buy With Prime having the same Prime ship speed now removes that concern. Better yet, Buy With Prime helps you access purchasers of your product on Amazon to your own website – where you can continue to strengthen the connection with that shopper, capture their info for remarketing, and benefit from a higher-margin transaction.

Realistically, a portion of your Amazon customers will continue to purchase your product on Amazon, even if Buy With Prime is implemented on your own ecommerce website. Amazon has other features, like Subscribe & Save options or unique coupons and discounts that your ecommerce site might not offer – keeping customers shopping on Amazon rather than your site. However, finding a way to leverage Amazon’s powerful new customer acquisition effectiveness with the value of forming a direct brand relationship is getting consistently more and more important.

The Challenge of Competitive Amazon Search Results

Amazon is the #1 product search destination for 61% of shoppers (whose search results in an online product purchase). Amazon has built a powerful suite of tools that enable brands to reach those shoppers in impactful ways, such as video at the top of search where purchase intent is high and New-To-Brand shopper acquisition is the strongest. However, this abundance of market capture opportunities has also resulted in high levels of competition, driving up cost-per-click (CPC) costs and reducing ROI. This makes the focus of driving loyalty and/or a direct relationship with shoppers more important than ever before.

Decreasing Organic Visibility & Increasing Amazon Ad Campaigns

Another element that has made the value of investing in Buy With Prime more important is the extent to which organic search visibility on Amazon has decreased. It has steadily gone down over the last 5 years as Amazon has shifted screen real estate away from organic search to targeted ad space.

Before the introduction of Amazon ads, the Amazon search algorithm very slowly learned the importance of products. Once a brand achieved a strong organic search ranking, its sales steadily grew. However, with the introduction of ads, organic rank visibility has diminished, and organic search listings were pushed farther down the search results page. With as much as 70% of Amazon sales for most brands coming from small mobiles screens, this challenge is even greater.

In a recent test search representative of the average Amazon search experience, we found that 77% of products in the top search results and the next 4 pages were paid placements. Such a significant portion of search results now being sold as ads presents a large challenge to efficient sales growth from organic placements. These challenges are only exacerbated with:

- The continual increase in competition for high-traffic category advertising terms

- Rich full screen ad campaign imagery

- Auto-play paid ad videos

- Ads that appear to be native-looking organic search results

Amazon Marketing Cloud for Advertising Targeting

Amazon has also continued to expose greater levels of data that fuel increased competition. For example, Amazon Marketing Cloud (AMC) now enables brands to see New-To-Brand purchase data across all ad types, tactics, and placements. This new technology coupled with more robust Amazon ad placement targeting capabilities have served to create an advertising frenzy towards targeting the top-of-search placements given the extent it yields New-To-Brand customer acquisition. Surprisingly, even defensive campaigns (like branded keyword ad bids) have also increased given the multitude of reason shoppers continue to turn to Amazon as a reliable retailer – such as convenience and brick & mortar out-of-stocks.

Amazon Marketing Cloud has been around for a few years, but previously it required both an in-depth knowledge of Amazon advertising and SQL knowledge. Amazon also previously only made it available to brands that were leveraging Amazon DSP display advertising. However, today Amazon Marketing Cloud is available to any advertiser, regardless of ad types used. Technology providers, such as Pacvue, Intentwise, and Skai, have made it increasingly easy to access without SQL knowledge. This increase in accessibility to meaningful performance data has only caused competition for those top-of-search placements to surge even higher.

AMC has truly been a game changer with regards to strategically and efficiently growing brands on Amazon and beyond. The ability and insight it provides in terms of new-to-brand customer acquisition effectiveness across all ad types, targeting nuanced audiences, and analyzing the ad combination purchase paths that provide the greatest effectiveness have been particularly impactful. With AMC being made available to all Amazon advertisers as of October of last year, now is a perfect time to lean in and leverage it to elevate your brand's performance on Amazon.

Amazon Search Results & Advertising Predictions

At some point, efficiencies will have to drop to where rising competition for placement cools off – right? Perhaps. Then again, brands favor spending ad dollars with Amazon because of its:

- Precise targeting

- High-purchase-intent audience

- Robust ad type offers

- Transparent performance measurement

- Off-site impact

- Efficiency with which New-To-Brand shoppers can be acquired

Brands are now shifting funds from traditional search and social platforms to Amazon. Meanwhile, other retail media networks are struggling to scale or offer the level of transparent performance results that Amazon does.

As competition within Amazon advertising continue to grow, it is entirely possible that only brands focused on customer acquisition and leveraging Buy With Prime (enabling them to retarget Amazon buyers and direct them to their D2C website), will continue to see sufficient goal attainment with Amazon advertising and continue to invest in it. Other brands who view Amazon more simply as “just another retailer” will see lower returns with each coming year, reducing their ROI and overall sales.

Engage & Grow Your Customer Base with Buy With Prime

Ultimately, only time will tell as market forces play out and shopper behavior continues to change. One thing is clear, though: if you are a brand concerned with growing your presence on Amazon and have an ecommerce enabled D2C website, strongly consider adding Buy With Prime to your strategy. Engaging directly with buyers of your product on Amazon will enable you to reach new audiences with your brand marketing and reduce remarketing costs while driving up conversion rates. Amazon reports that Buy With Prime can increase conversions by as much as 25% on average due to its:

- Frictionless checkout experience

- Trusted secure payment process

- Fast Prime shipping

- Convenience for shoppers on your website

Maximizing your brand’s value from Buy With Prime starts with optimizing your presence on Amazon:

- Ensure your full assortment is buyable and retail-ready with great content.

- Work with Amazon experts like Brandwoven to ensure any unpaid opportunities are exploited.

- Use your Amazon brand store for curated product discovery.

- Deploy a robust Amazon advertising strategy that implements balanced ad targeting. Include high-traffic category terms, competitor page placements, and branded defensive ads.

- Utilize Amazon DSP for extended reach and nuanced targeting capabilities.

All of the above will help your New-To-Brand customer audience size grow on Amazon, ensuring retargeting opportunities post-Buy With Prime implementation is successful.

Conclusion

Amazon’s importance as a sales channel and advertising publisher will only continue to grow, as will competition within its marketplace. Brands with D2C enabled ecommerce sites have a unique opportunity to leverage Buy With Prime to gain a long-term strategic advantage.

Brandwoven is uniquely positioned to help you achieve marketplace and off-Amazon success. Our expertise in Amazon management coupled with our sister growth consulting agency Graybox’s, focus on ecommerce platform implementations, we can excel your brand’s growth online. While many other agencies shy away from something as involved as an overarching ecommerce strategy involving both marketplace and D2C, we lean in because that is where Amazon is moving. If this aligns with your plans or even sounds like a moderately good fit for your brand and current strategy, please reach out as we’d love an opportunity to discuss our capabilities with you further.