This year, Amazon Turkey 12 (T12) dates were Thursday, November 20 through Monday, December 1, including Black Friday (November 28) and Cyber Monday (December 1). This sales period is critical for brand participation, as Q4 conversion rates reach their peak, especially on Black Friday & Cyber Monday (or “BFCM” for short). Early engagement has become a competitive advantage, with successful brands nurturing customer relationships and laying groundwork weeks in advance.

BFCM 2025 sales trends showcase shifts in consumer behavior and the rising dominance of AI in ecommerce.

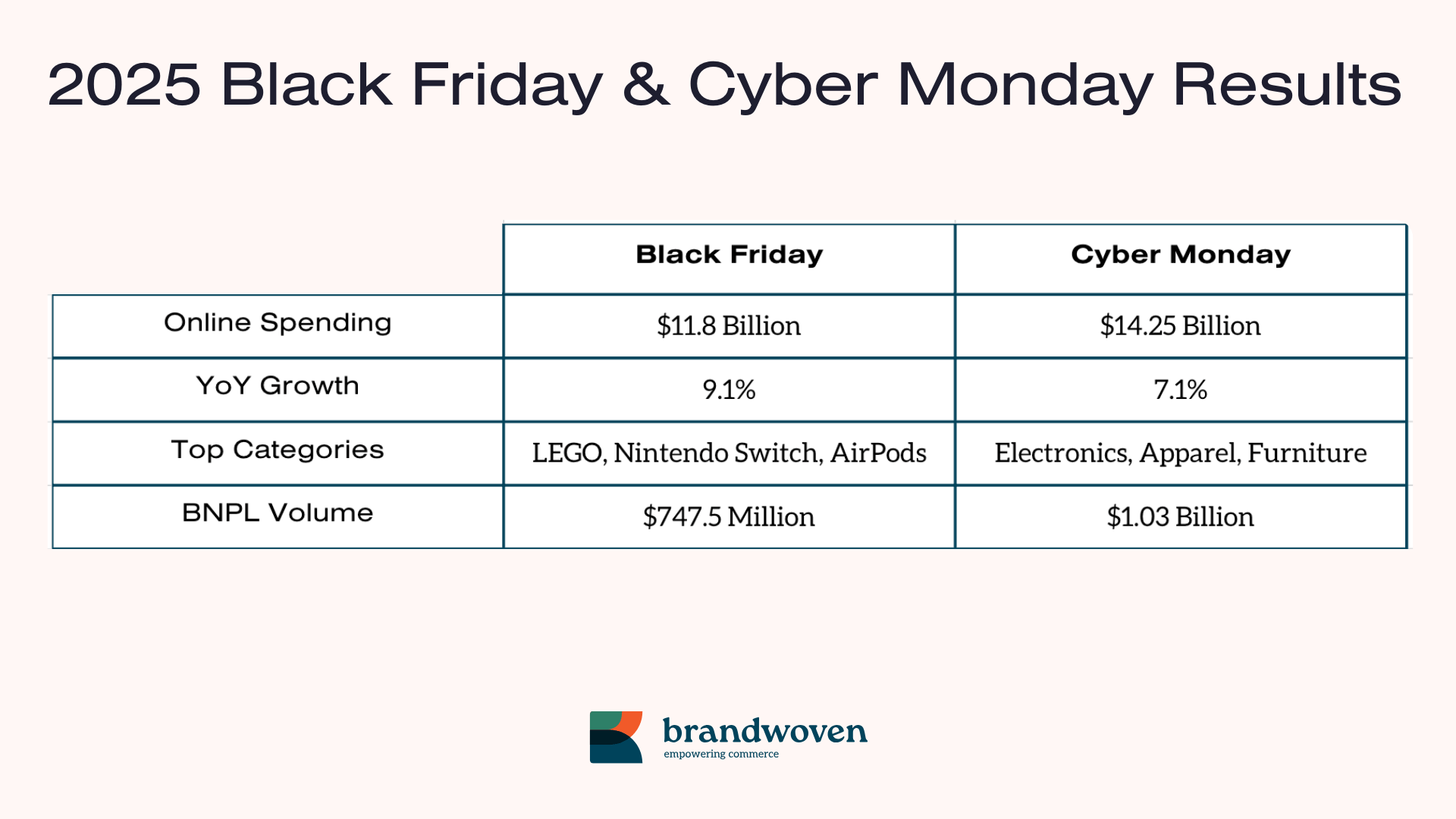

BFCM Sales Results 2025

The Cyber Five weekend specifically (Thanksgiving through Cyber Monday) generated massive results with $44.2 billion in online spend. Black Friday’s growth rate (9.1%) outpaced Cyber Monday’s (7.1%), indicating that consumers are increasingly making major purchases earlier in the weekend. However, Cyber Monday still maintained its title as the largest single online shopping day of the year.

Despite massive sales records set, these figures are complicated by inflation, with elevated prices weighing on demand. eMarketer reported that consumers purchased fewer items per checkout, with units per transaction down 2% and an overall 1% drop in order volumes YoY.

T12 on Amazon Marketplace

Brands selling on Amazon marketplace faced a highly competitive environment, characterized by increased Cost Per Click (CPC) as sellers aggressively competed for the T12 period. Crucially, some Amazon sellers encountered a widespread glitch where approved and active Black Friday/Cyber Week deals were quietly suppressed unless the sellers lowered the price even further. This happened without any notification, email, or obvious dashboard flags, leading to the potential loss of the price badge, visibility, and the deal entirely.

Walmart Leans Into Brick & Mortar Presence and Fulfillment

Walmart leveraged its massive physical footprint to win with logistics. Rather than competing solely on price, Walmart focused on fulfillment speed, reporting a 57% year-over-year increase in orders delivered from stores. 44% of Black Friday orders specifically were delivered to customers’ doorsteps in under three hours.

The retail giant also successfully bridged the physical-digital divide, with nearly 10 million shoppers using the Walmart app while inside stores to navigate aisles and compare pricing.

Target Struggles to Uphold Momentum

Target faced a more challenging holiday kickoff. Despite initially winning the morning on Black Friday by offering exclusive in-store giveaways that drove early lines, the retailer struggled to maintain momentum.

- Traffic: Foot traffic remained largely flat compared to 2024, lagging behind the gains seen by Walmart (+2.1%).

- Sales Context: This performance follows a Q3 trend where comparable sales declined 3.8%, suggesting that Target’s heavy reliance on discretionary goods (apparel, home decor) continues to be a vulnerability in an inflation-wary economy.

TikTok Shop Emerges as a Growing Marketplace, Offering New Opportunity for Brands

TikTok Shop was the breakout star, solidifying its position as a major player in U.S. ecommerce, reporting over $500 million in gross merchandise volume (GMV) during the BFCM sales weekend.

- Top Categories: High-performing product categories included Beauty & Personal Care, Health, and Collectibles.

- Growth: TikTok Shop saw a nearly 50% increase in the number of unique shoppers compared to the same period in 2024.

Black Friday 2025 Results & Trends

Online shopping on Black Friday (Nov. 28) reached a record $11.8 billion in the U.S., reflecting a 9.1% jump from 2024. Overall U.S. retail sales (excluding automotive) grew 4.1% year-over-year (YoY), while ecommerce sales rose 10.4% YoY.

Black Friday Trends:

- Artificial Intelligence:

- The record sales were driven, in part, by the rise of AI-powered shopping tools. AI and digital agents accounted for $14.2 billion in global online Black Friday sales ($3 billion from the U.S.) per software firm Salesforce.

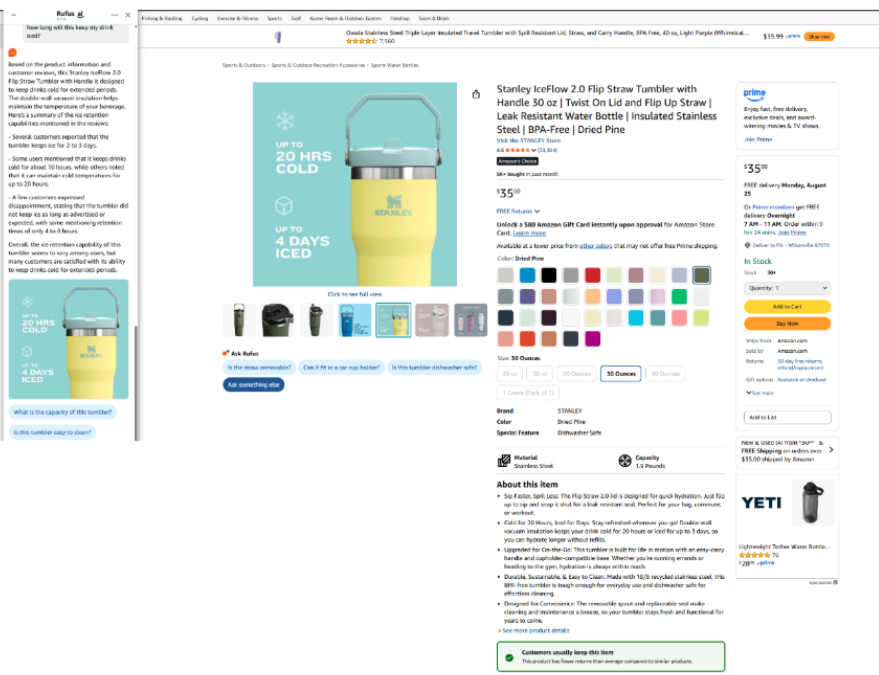

- Amazon’s generative AI chatbot, Rufus, saw significant adoption. Amazon sessions that used Rufus and resulted in a purchase surged 100% compared with the trailing 30 days. Day-over-day, Rufus-enabled purchase sessions grew 75% on Black Friday.

- Discounts: The average online discount rate was 28%, consistent with the previous year. Shoppers found notable bargains in categories like toys (up to 30% off), electronics (down 29%), TVs (down 24%), and apparel (down 25%).

- Top Products: Top-selling items included LEGO sets, Pokémon cards, Nintendo Switch, PlayStation 5 consoles, Apple AirPods, and KitchenAid mixers. Luxury apparel and accessories were also leading categories.

- Buy Now, Pay Later (BNPL): Volume reached $747.5 million in online spending on Black Friday alone, an 8.9% YoY increase, setting a record.

- Consumer Behavior: Elevated prices weighed on demand, contributing to a 1% drop in order volumes YoY. Consumers purchased fewer items per checkout, with units per transaction down 2%.

Cyber Monday 2025 Results

Cyber Monday 2025 (Dec. 1) closed the weekend with strong results, generating $14.25 billion in the U.S., a 7.1% YoY gain. This secured its position as the biggest U.S. online shopping day in history.

Cyber Monday 2025 Trends:

- Categories: Three categories accounted for 57% of Cyber Monday’s 2025 online sales results: electronics (up 12.8% vs last year), apparel (up 5.2%), and furniture (up 5.4%). Consumers stocked up in these areas where prices have risen and are expected to increase.

- BNPL Peak: Usage set a new single-day record, driving $1.03 billion in sales, a 4.2% YoY gain. Total BNPL spending from November 1-30 reached $9.0 billion, up 9.6% YoY.

BFCM Sales Trends: What Stood Out?

These BFCM results highlight several defining shifts that will shape the remainder of Q4 (holiday/Christmas shopping) and 2026 strategy planning:

AI: The Core Business Driver

The most significant trend was the mainstream adoption of AI for commerce.

- AI-driven traffic to U.S. retail sites surged 805% year-over-year.

- U.S. shoppers who came to a retail site from an AI service were 38% more likely to buy compared with non-AI traffic sources.

Consumers are using AI for discovery, recommendations, product comparisons, and deal finding. Marketers must optimize for algorithmic discovery.

The Split Consumer Economy

A notable split is emerging in shopper behavior:

- High-Income: These consumers demonstrate robust spending, driven by wealth effects from stock market gains and home appreciation.

- Low-to-Moderate Income: Spending here is more muted but still growing, supported by continued wage growth and tools like BNPL.

Additionally, eMarketer noted that some consumers are engaging in defensive decision making (leaning toward value and low-risk purchases), while others are engaging in retail therapy (seeking purchases as emotional coping mechanisms). Brands should balance messaging, offering both dependable value and small indulgences to capture consumers.

Livestream Commerce: Shopping Meets Entertainment

Black Friday 2025 included an emerging trend in livestream shopping, which surged during the sales event. Shoppers spent over $75 million on the live shopping platform Whatnot during Black Friday, a figure that is three times greater than the previous year’s total. Whatnot also saw a fourfold increase in first-time buyers compared with last year’s Black Friday event, with shoppers purchasing an average of 40 items per second.

Other platforms are also experiencing momentum:

- TikTok Shop: Live shopping was the primary engine of growth on the marketplace over BFCM, with sales from livestreams jumping 84% YoY. Over 1.6 billion views were generated across 760,000 livestream sessions.

- eBay Live: eBay’s live shopping initiative is gaining traction in both the U.S. and the U.K., notably driven by its popularity in the collectibles space and supported by streams featuring celebrities. eBay has seen consistent Quarter-over-Quarter (QoQ) growth across key performance indicators, including viewers, watchtime, items sold, and GMV.

Looking ahead, U.S. livestream ecommerce sales are expected to rise by nearly 50% this next year to $14.64 billion, with a 21.5% jump in the number of buyers.

Image source: https://www.whatnot.com/seller

Amazon T12 & BFCM Conclusion

Amazon T12 kicked off the holidays and reinforced that while massive sales records were set, these figures were complicated by inflation, leading to lower units purchased per transaction. The sales momentum now hinges heavily on technological adoption, with AI tools, like Amazon’s Rufus, fundamentally reshaping the path to purchase. Consumers are actively seeking deals and relying on alternative payment methods like BNPL to manage expenses.

To prepare for success in 2026, brands should audit their product pages for algorithmic discovery, transition marketing efforts toward full-funnel environments, and invest in differentiated brand messaging to provide a clear value that transcends temporary price reductions and leads to loyal, long-term buyers.