Article

Amazon 2026 Fees Breakdown: FBA, Referral, Inbound Placement

Following a year of little-to-no fee increases in 2025, Amazon has now announced an abundance of fee changes coming to sellers on its marketplace in early 2026. Sellers on Amazon’s US marketplace will see changes in Fulfillment by Amazon (FBA), referral, and inbound placement fees beginning January 15, 2026. We’re going to break down the most important fee changes, what they mean for seller profitability, and actions to protect margins.

How Do 2026 Amazon FBA Fee Calculations Compare to 2025?

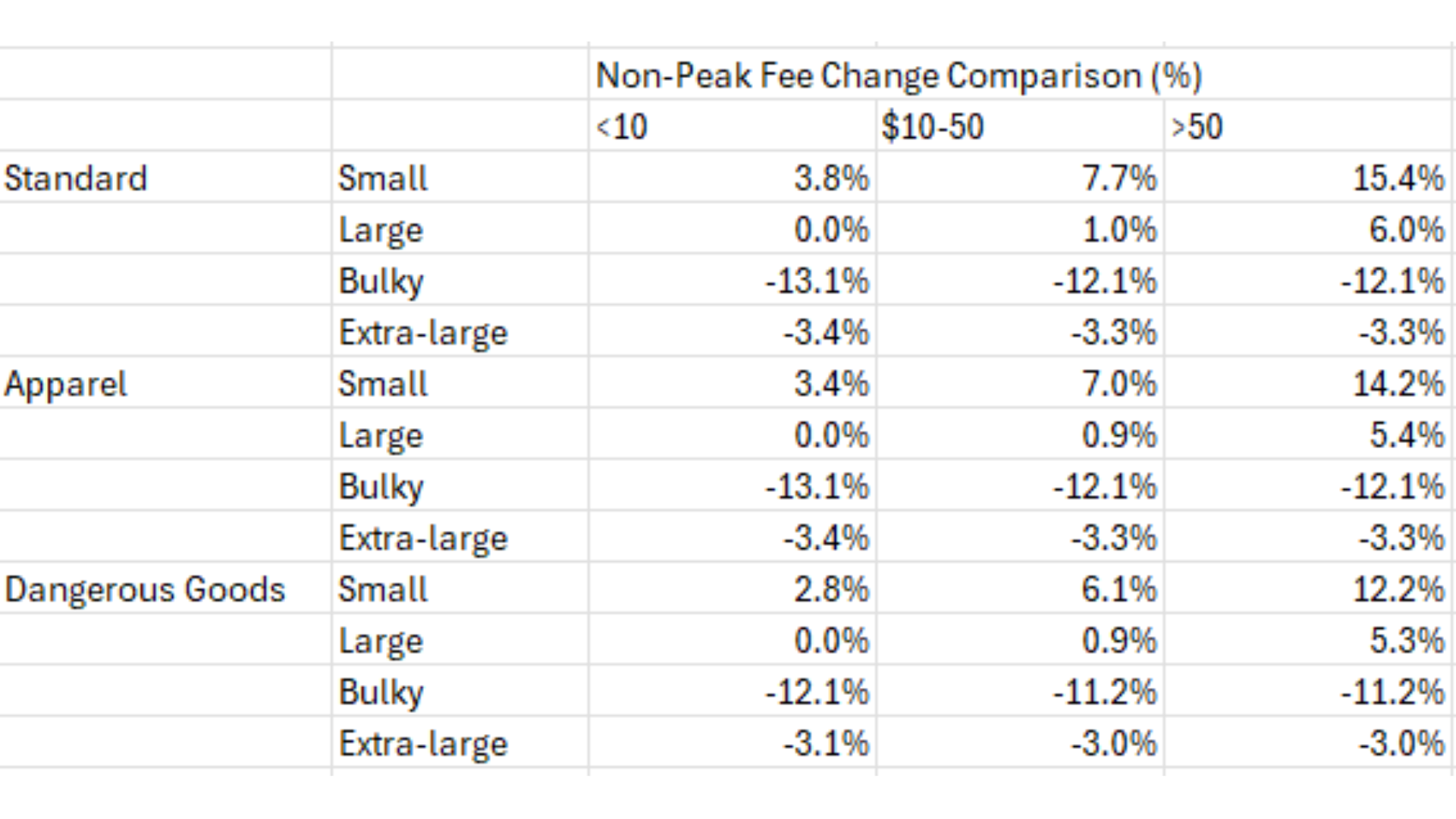

Product price will also now be a factor when determining FBA fulfillment fees, with the following tiers:

- <$10 (Low Price tier)

- Increases of $0.12 per unit on average for small standard-size products.

- $10-$50

- Standard-size products will increase by $0.08 per unit on average.

- >$50

- Higher increases, averaging $0.31 per unit.

See the table below with YoY comparison averages (non-peak):

The majority of Brandwoven client products are Large Standard, which will see an average YoY increase of 6%.

The majority of Brandwoven client products are Large Standard, which will see an average YoY increase of 6%.

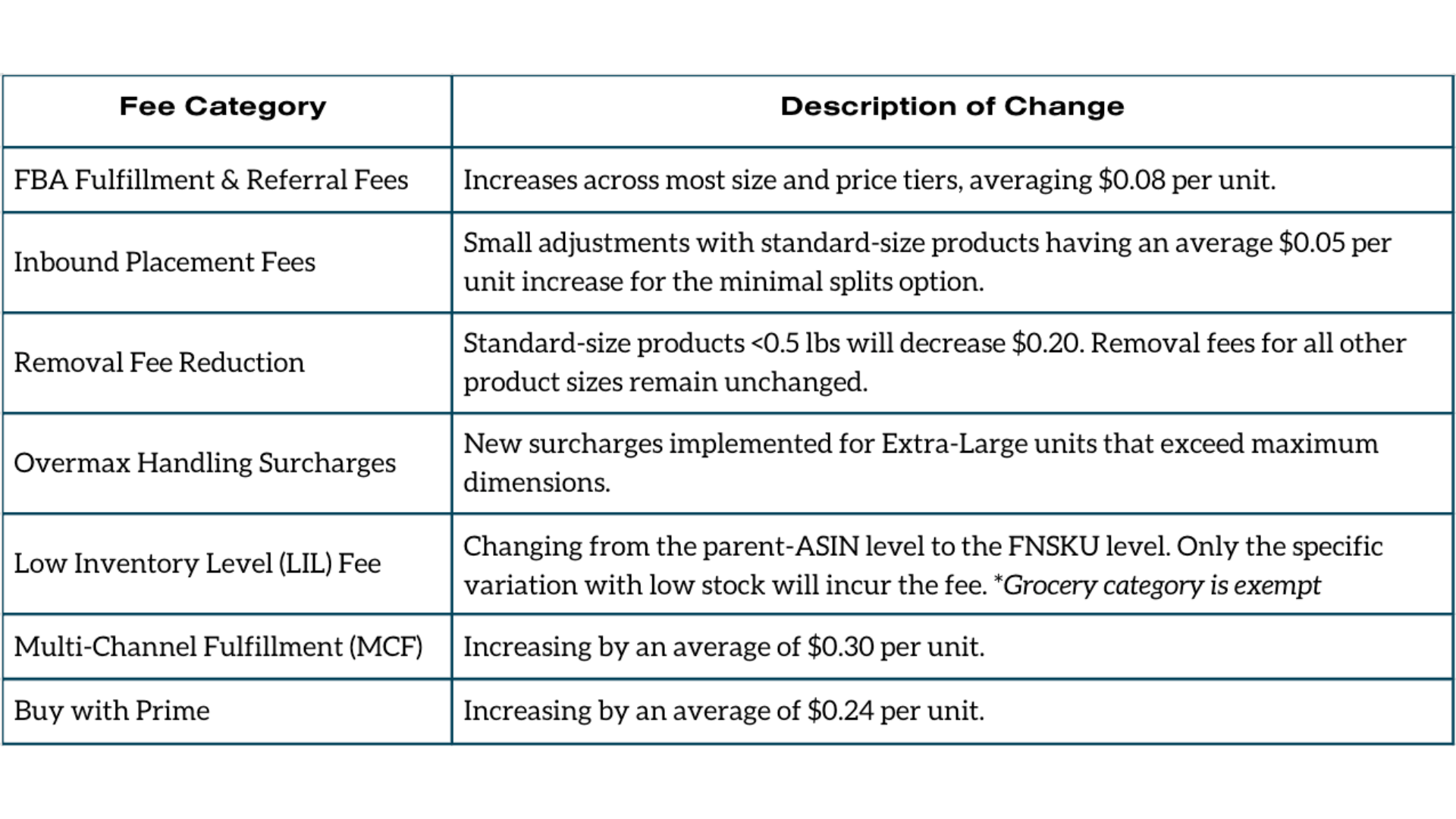

High-Level Look at All 2026 Fee Changes on Amazon

*All dollar figures cited exclude apparel and dangerous goods.

Most Impactful 2026 Amazon Referral & FBA Fee Changes

With all the fee changes coming in 2026, what stands out as the most impactful to brands on Amazon’s marketplace?

Small Products Over $50 Face Biggest Fees

Standard-size FBA products priced above $50 will see the most significant fee increase of an average $0.31 per unit. These premium products, especially those that are high volume, will see the most substantial margin impact as a result.

Small standard products over $50 will face a 15.4% non-peak fee change increase compared to the current fee structure. Although a notable impact, one way to avoid it is by dropping product price (where a comparable small standard size product between $10-50 would face half the non-peak fee change increase at only 7.7%, however still an increase at that). Likely reducing price (unless sitting very close to $50 where margin could afford it) will not be a viable solution for most brands.

Brands with FBA products priced at $49.99 should not look to increase prices if they can as to avoid the surge in fees if surpassing a $50 price point. We may see high $40-priced products stay at their current price for a while or, if their price needs to increase, push significantly above $50 to offset the increased FBA fee that will come with doing so.

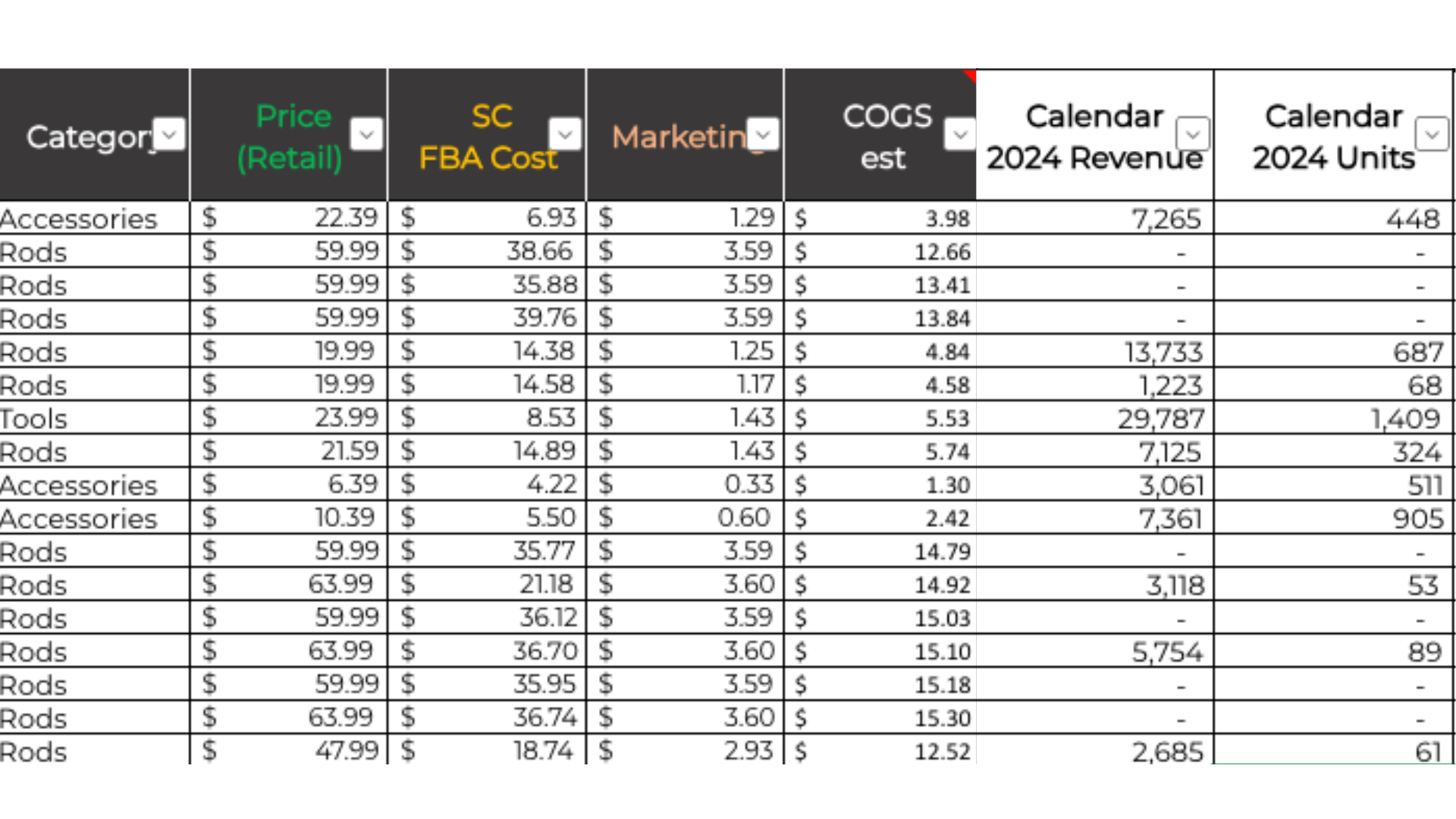

Best Update: New Small Bulky Size Tier

The biggest win to come from the 2026 fee update will be for FBA products that fall under Amazon’s new size tier called “Small Bulky” that would have previously been in the Large Standard size and above 3 pounds. These products will see the largest decrease in fees.

Previously, products that had a longest side over 18 inches and/or were greater than 20 pounds went from large standard to large bulky. However, now products with a longest side between 18-37 inches or 20-50 pounds will be in the new Small Bulky category. These fees are quite a bit lower for products that meet this change with a decrease between 21.4% and 23.3%, depending on price. For example, a 10-pound product would have had a $9.61 FBA fee before but only $7.55 under this new tier (assuming a $10-50 price).

Other small standard size FBA products between $10-50 (like beauty) will increase by $0.25 per unit on average.

Update to Inbound Placement Fees

Inbound placement fees will now have more size tiers with fees increasing for all items excluding small standard < 8oz:

- Amazon uses a min/max amount based on product size. The upper limit for Large Standard is increasing on average by $0.40 per unit.

- Items < 5 pounds will see the smallest increase at an average of $0.06. Items > 5 pounds will see an average increase of $0.72 per unit.

- Amazon-optimized shipments will continue to have no inbound fees. Brands should consider operational changes that will allow them to meet the Amazon-optimized shipment criteria to minimize inbound fees.

More 2026 Amazon FBA Fee Changes to Prepare For

Small & Large Bulky Incur Packaging Fees (If Not Enrolled in SIPP)

Small and Large Bulky sized products that can’t ship in their own packaging (i.e. are not enrolled in Amazon’s Ship in Product Packaging program, or SIPP) will incur additional packaging fees ranging from $1.51 to $4.04 depending on weight.

Using the SIPP program allows brands to ship products in their original packaging, meaning Amazon avoids adding extra packaging materials (hence the increased fee for those who don’t participate). We strongly recommend brands check if their items in these product size tiers (small and large bulky) are eligible for SIPP enrollment to avoid these additional packaging fees.

New Overmax Handling Fee for Extra Large Units

A new “overmax” handling fee will be added for FBA products that exceed certain dimensions: longest side >96” or length + girth of>130”.

The overmax fees range from $17-$25 depending on weight, so it will be a significant change for brands that are shipping extra large units to FBA. Most Brandwoven clients won’t be affected by this, but some examples may include:

- Fishing brand shipping a 1-piece fishing rod

- Extra large products like tankless water heaters

Low Inventory Level (LIL) Fee Shifts to FNSKU Level

A new change to the Low Inventory Level (LIL) fee will affect FBA sellers with product variations. The LIL fee calculation is shifting from the parent-ASIN level to the FNSKU level (Grocery category is exempt).

Under this new system, if your overall product stock is healthy but one specific child variation (FNSKU) falls below 28 days of supply, that specific FNSKU will incur the fee – not the entire product family. The fee is only relevant to an FNSKU that has sold 20+ units in the past seven days.

Get Help with Product Forecasting from Brandwoven

Get Help with Product Forecasting from Brandwoven

One of Brandwoven’s key service offerings is product forecasting. It has always been crucial to have the right amount of product in stock, and this continues to rein true with the LIL fee impacting variation profitability. We know that inventory planning can be complex and time consuming, which is why we’ve taken this burden off many of our clients’ plates. Brandwoven produces advanced, item-level forecasts across catalogs of any size for our ecommerce clients. Combining our team’s marketplace expertise with a powerful forecasting tool has resulted in 95%+ in-stock rates while ensuring inventory is turning over every 60 days, yielding high conversion rates and minimizing storage fees. Anyone needing help conducting advanced forecasting and demand planning should reach out to our team to talk through unique challenges and areas where we can assist.

How Amazon Brands Should Prepare for Increased Fees

While the changes can seem overwhelming, Amazon has provided at least 90 days of prep time before the new rates take effect in mid-January 2026. Regardless of prep time, these 2026 fee updates will impact brand profitability, with some requiring operational changes.

Quantify the Impact

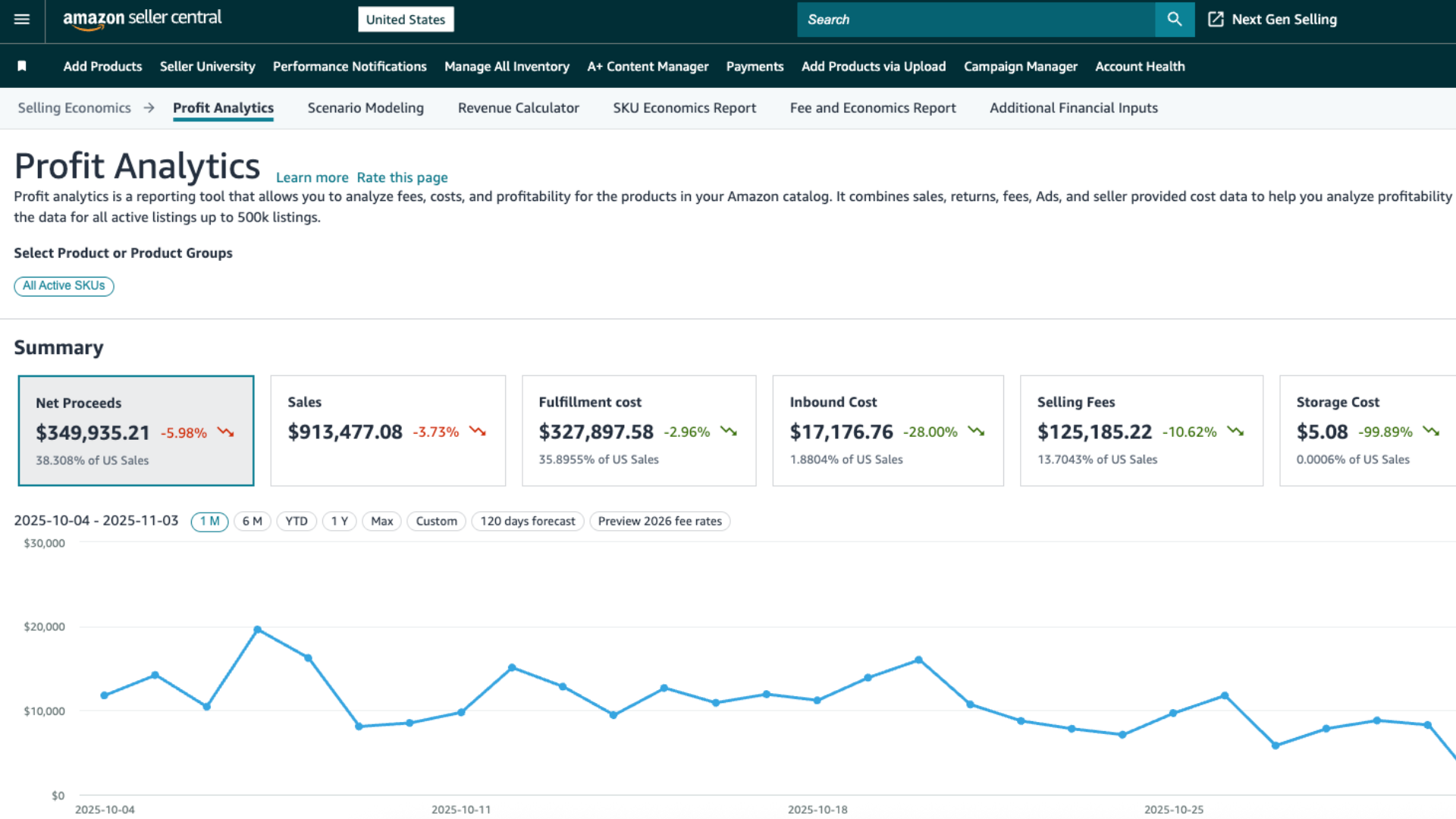

The most critical first step is to quantify the specific impact of the new fee structure on your individual products.

- Identify Applicable Fees and Analyze Impact: Do not rely solely on the “average of 8 cents per unit sold” because fee increases vary dramatically by product size and price tier. Amazon has shared the following resources for sellers:

- Revenue Calculator for comparing revenue estimates based on the fulfillment channel used.

- Profit Analytics dashboard to get a detailed view of units and see exactly how the fee changes impact each product.

- Fee and Economics Preview Report analyzing the specific economic impact of the updates.

- Conduct an Updated Profitability Analysis (Recalculate Everything): Accommodate all the new variables being introduced for 2026 when auditing your product margins. It’s also crucial to recalculate profit as your prices change (or you run discounts) and when adding new products to your Amazon catalog.

5 Areas to Optimize for Margin Recovery

Once you understand where you will be impacted, implement strategies to recover costs where you can.

- Fix Packaging and Enroll in SIPP:

- Update product packaging to potentially achieve lower fees. SIPP (Ships in Product Packaging) certification is becoming more and more strategic, resulting in lower FBA fulfillment fees. Small and Bulky products that are not certified as SIPP will incur additional fees.

- Tighten Inventory Management:

- The changes to the Low Inventory Level (LIL) fee structure demand better inventory planning. Forecast tighter and ensure all variations stay in stock to avoid the fee.

- Optimize Inbound Shipping Strategy:

- Opt for lower-cost inbound shipment options like the Amazon-optimized shipment splits option which carries no fee.

- Explore International Markets:

- These fee changes reinforce the need for brands to invest in other marketplaces and global expansion as costs rising in one region (US) create an opportunity to improve margins by expanding your ecommerce footprint.

- Consider Non-Amazon Fulfillment:

- If using Amazon’s fulfillment services for your omni-channel strategy, like Multi-Channel Fulfillment (MCF) which allow sellers to use FBA inventory to fulfill orders from other marketplaces or their own website, or Buy With Prime (BWP) which allows ecommerce sites to offer Prime checkout and shipping options to customers, consider non-Amazon fulfillment options as a replacement to save on fees.

Why is Amazon Increasing Fees in 2026?

Efficiency and Investment in Enhanced Services

The primary justification Amazon has given for increasing all these fees is the need to invest further in innovation and efficiency, such as the following areas:

- Improved forecasting

- Inventory placement

- Automation

- Service for higher-priced products

- Reducing defects (that cause missing and damaged inventory)

- Improving the returns experience

- Processing removals faster

Alignment with Amazon’s Operational Costs

Amazon states the changes are also designed to better align fees to their underlying costs. This involves creating more granularity in the fee structure, enabling Amazon to offer lower fees where costs are lower, and impose higher fees where enhanced services or additional value is provided. In other words, Amazon is protecting its own profitability while claiming to be fairer to sellers in the areas where fees are increasing.

Contextual Justification

Amazon frames the fee changes (an average increase of $0.08 per unit sold) as minimal and part of a standard annual cost review and service improvement cycle. The company spun these fee increases as a generally positive thing, stating they are:

- Significantly less than inflation

- Lower than the 3.9% to 5.9% annual cost increases implemented by other major US carriers over the last two years

In essence, these updates are designed to penalize poor FBA product management and push sellers toward using programs like SIPP.

Preparing For Amazon Marketplace Fees with Brandwoven

These 2026 Amazon FBA fee changes serve as a powerful reminder that Amazon is a business partner whose costs are constantly evolving, and maintaining profitability requires a multi-channel approach.

Reach out to our team for a profitability analysis to help your brand prepare for these changes. We’ll walk you through operational improvements that will protect your margins in 2026.